Gross Income Calculator Ohio

Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. One of a suite of free online calculators provided by the team at iCalculator.

What Is The Difference Between Gross Pay And Net Pay Ontheclock

For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300.

Gross income calculator ohio. Begin with your federal adjusted gross income Ohio IT 1040 line 1. Ohio local income taxes which are referred to unofficially as the RITA Tax range from 05 to 275. The Ohio tax calculator is designed to provide a simple illlustration of the state income tax due in Ohio to view a comprehensive tax.

For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. The steps to calculating your tax liability are as follows. In this circumstance this calculator will not be able to calculate an estimated obligation.

Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. Ohio has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. If you are paid hourly multiply your hourly.

There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax. Below are your Ohio salary paycheck results. You will need to consult legal counsel andor proceed through the court or child support enforcement agency to determine the obligation.

The Ohio Salary Calculator allows you to quickly calculate your salary after tax including Ohio State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Ohio state tax tables. 10 -Ohio Corporate Income Tax Brackets. It works for either individual income or household income or alternatively only to compare salary wage income.

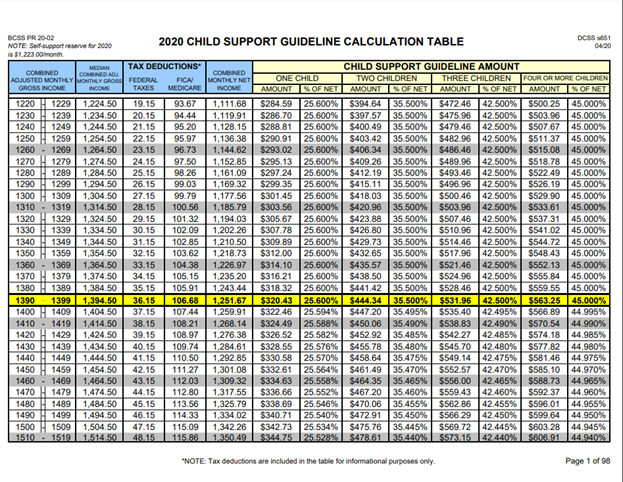

The living wage shown is the hourly rate that an. This calculator cannot be used to calculate a support obligation for circumstances where the parties have a combined annual gross income above 336000. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Ohio. Salary Paycheck Calculator. It determines the amount of gross wages before taxes and deductions that are.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. How Income Taxes Are Calculated. For the calculation we will be basing all of our steps on the idea that the individual filing their taxes has a salary of 6000000.

In this article we discuss what annual gross income is and how you can calculate it based on your own circumstances. 23 rader Living Wage Calculation for Ohio. Tax Bracket gross taxable income Tax Rate 0.

This is typically calculated on your federal 1040. Rates range from 0 to 4797. Gross annual income is a number you may need often in your life to help manage your finances and plan for the future.

The results are broken up into three sections. You can also choose comparison states and show the income. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

On this page is a 2020 income percentile by state calculator for the United States. Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA. The changes in Ohio child support calculation are intended to reflect the reality most Ohio families are living and to bring support levels more in line with what families are actually spending on their children.

Whereas the old worksheet calculated gross family income only up to 150000 the new worksheet can consider gross family incomes up to 336000 combined. Enter pre-tax income earned between January and December 2019 and select a state and income type to compare an income percentile. If you earn 6000000 or earn close to it and live in Ohio then this will give you a rough idea of how much you will be paying in taxes on an annual basis.

Your results have expired. Calculate Gross Pay. Use this Ohio gross pay calculator to gross up wages based on net pay.

The Ohio tax calculator is updated for the 202122 tax year. You have indicated that one or both parents have an income greater than 336000. Ohio has a progressive income tax system with six tax brackets.

Income required to continue. This tax calculator performs as a standalone State Tax calculator for Ohio it does not take into account federal taxes medicare decustions et al. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. If this circumstance applies you should consider contacting an attorney andor your local child support enforcement agency. Ohio corporations still however have to pay the federal corporate income tax.

Ohios individual income tax is calculated on form IT 1040 and its supporting schedules. To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period.

There are a few simple formulas you can use to figure out your own gross annual income whenever you need it.

Ohio Child Support Laws Recording Law

Ohio Paycheck Calculator Smartasset

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

Income Retirement Income Department Of Taxation

Paycheck Calculator Take Home Pay Calculator

Ohio Child Support Calculator 2021 Simple Timtab

Health Insurance Marketplace Calculator Kff

What Is Gross Receipts Tax Overview States With Grt More

Imputing Income For Ohio Child Support What S Changed

Income School District Tax Department Of Taxation

Paycheck Calculator Take Home Pay Calculator

My First Job Or Part Time Work Department Of Taxation

Ohio Paycheck Calculator Smartasset

Ohio Salary Calculator 2021 Icalculator

What Is Gross Income For Ohio Child Support Purposes

Https Www Ohio Edu Sites Default Files Sites International Week Updatedfiling 20a 20state 20of 20ohio 20and 20ohio 20school 6 29 20 Pdf

Income Ohio Residency And Residency Credits Department Of Taxation

Post a Comment for "Gross Income Calculator Ohio"