In Hand Salary Calculator With Variable Pay

Finally using the above value we can compute the in hand salary as follows. The Salary Calculator calculates your PF and EPF to be 12 of your Basic Pay and Gratuity as 481 of Basic Pay.

Bonus Plan Template Excel Fresh Excel Template For Pcb Bonus Calculation How To Plan Payroll Template Business Plan Template

Enter annual CTC amounts and then select the compliance settings as per your establishment applicability 2.

In hand salary calculator with variable pay. Meeras CTC is Rs. What is a Salary Calculator. Calculating in-handtake home salary.

Why not find your dream salary too. The IDC multiplier is announced every 6 months and will be communicated to you before each payout cycle. The salary calculator has become useful in a company when the company is planning and implementing the initiative for Human resource cost reduction the calculator can be useful in computing salaries and the compensation paid to the staff and the top management and can help to identify the roles which are overpaid or are redundant.

Professional tax varies from state to state but we approximate it to Rs200month. A quick and efficient way to compare salaries in the Netherlands review income tax deductions for income in the Netherlands and estimate your tax returns for your Salary in the Netherlands. The Netherlands Tax Calculator is a diverse tool and we may refer to it as the Netherlands wage calculator salary calculator or the Netherlands salary after tax calculator.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. In-Hand salary means Take home pay in India.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to federal income taxes if. In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any.

The salary calculator consists of a formula box where you enter the Cost To Company CTC and the bonus included in the CTC. If you are looking to automate you Organisations CTC salary structure in excel then you can download PayHRs Latest Excel CTC Salary Calculator in which you can customize your cost to company as per your company policy. Fixed pay is what is defined and fixed and you will get the same salary which was stated in the letter of salary structure.

Also we have not included variable pay and income from other sources. Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. PayHR Online CTC salary calculator helps HR and Payroll Accountants to calculate how much Net Salary to be paid to employees based on agreed CTC.

However this is likely to change if you get an appraisal of sorts or get a raise on your salary. So Variable pay is the part of your. Calculate your take home pay in the Netherlands thats your salary after tax with the Netherlands Salary Calculator.

Calculate exact in-hand salary with the help of our free take-home salary calculator. So for the role you play at the office you receive the fixed salary and variable salary is not the same. The funny thing is that even if you are 100 billable the billability will show as 95.

Online CTC Calculator. So fixed pay 630000 pa Monthly fixed pay 63000012 52500 Now Components PF 2000 Gratuity 800 Monthly Gross pay 52500 - 2800 49700 Inhand Salary 49. If your PF is paid as a different percentage you need to enter the actual mount paid to you in the PF field for accurate calculations.

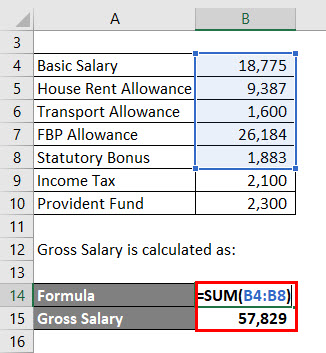

Lets take an example to understand how to calculate take-home salary. The salary calculator is a simulation that calculates your take-home salary. Take Home Salary Basic Salary Actual HRA Special Allowance - Income Tax - Employers PF ContributionEPF Example.

In-hand is a word used in daily life to mean the final amount received after the deduction of taxes. That means that your net pay will be 40512 per year or 3376 per month. Take home salary Gross Salary - Income Tax - PF - Professional tax Note.

All the variable fields amounts limits and the percentages can be customized based on your needs. 7 lpa ctc including 10 variable. FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc.

When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Last point is very important because all other point can be include in variable pay calculation but last part of factoring total kitty amount is difficult we can do that by taking weighted average of our calculation. Variable Pay - Variable Salary.

You usually get this amount as a standard pay for the work that you are supposed to do during the time you were present at the office. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000. The latest budget information from April 2021 is used to show you exactly what you need to know.

The variable pay varies from 15 to 18. It is the total salary an employee gets after all the necessary deductions. 29th October 2009 From India Mumbai.

Your package Fixed PayX of total package Variable pay100-X of total package. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Your average tax rate is 221 and your marginal tax rate is 349.

It is solely dependent upon your rating and current pay. Inhand salary will be 47k without TDS. Hourly rates weekly pay and bonuses are also catered for.

There may also be contributions toward insurance coverage retirement funds and other optional contributions all of which can lower your final paycheck.

What Will Be The Monthly In Hand Salary If The Ctc Is 9 5 Lpa

1040 Income Tax Cheat Sheet For Kids Consumer Math Financial Literacy Lessons Consumer Math High School

Salary Formula Calculate Salary Calculator Excel Template

Whether You Are Bootstrapped Or Raised A Series B You Are Probably Wondering What Your Founder Salary Should Be Right On T Salary Salary Calculator Start Up

Salary Formula Calculate Salary Calculator Excel Template

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Basic Monthly Budget Form For Weekly Pay Pdf Google Sheet Etsy Budgeting Worksheets Weekly Budget Template Budgeting

Logicfoo Limited Java Program Solved Logicprohub In 2021 Solving Programming Tutorial Hours In A Week

Salary Formula Calculate Salary Calculator Excel Template

Maths Tutorial Independent And Dependent Variables In Statistics Math Tutorials Math Levels Of Education

Income Salary Rate Increase Concept Illustration With People Character And Arrow Finance Performance Of Return On

Salary Calculator 2020 21 Take Home Salary Calculator India

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Sinking Funds Tracker Sinking Fund Printable Sinking Funds Budget Savings Tracker Expenses Editable Pdf Calculations Done For You Video Video Sinking Funds Budgeting Budgeting Money

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

Post a Comment for "In Hand Salary Calculator With Variable Pay"