Gross Pay Calculator Qld

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. A pay period can be weekly fortnightly or monthly.

Free Payslip Template Payslip Generator Xero Au

This Calculator is based on the publicly available guidelines and publications about redundancy payment that can be found in the Notice of Termination Redundancy Pay guide based on National Employment.

Gross pay calculator qld. How to calculate ordinary wages. This estimator will help you to work out an estimate of your gross pay and the amount withheld from payment made to you as a payee where. You need to pay payroll tax in Queensland if you are an employer or group of employers who employs in Queensland and your Australian taxable wages exceed the payroll threshold of 13 million a year.

Award and over-award wage payments. 3 You are entitled to 25000 Low Income Tax Offset. Gross and Net Calculator.

The Tax Assessment Calculator allows you to calculate what tax is payable on your Gross Annual Income on a per annum bases. Simply enter your Gross Income and select earning period. The app will work on all ios devices including iPad iPhone and iPod touch and will update every year.

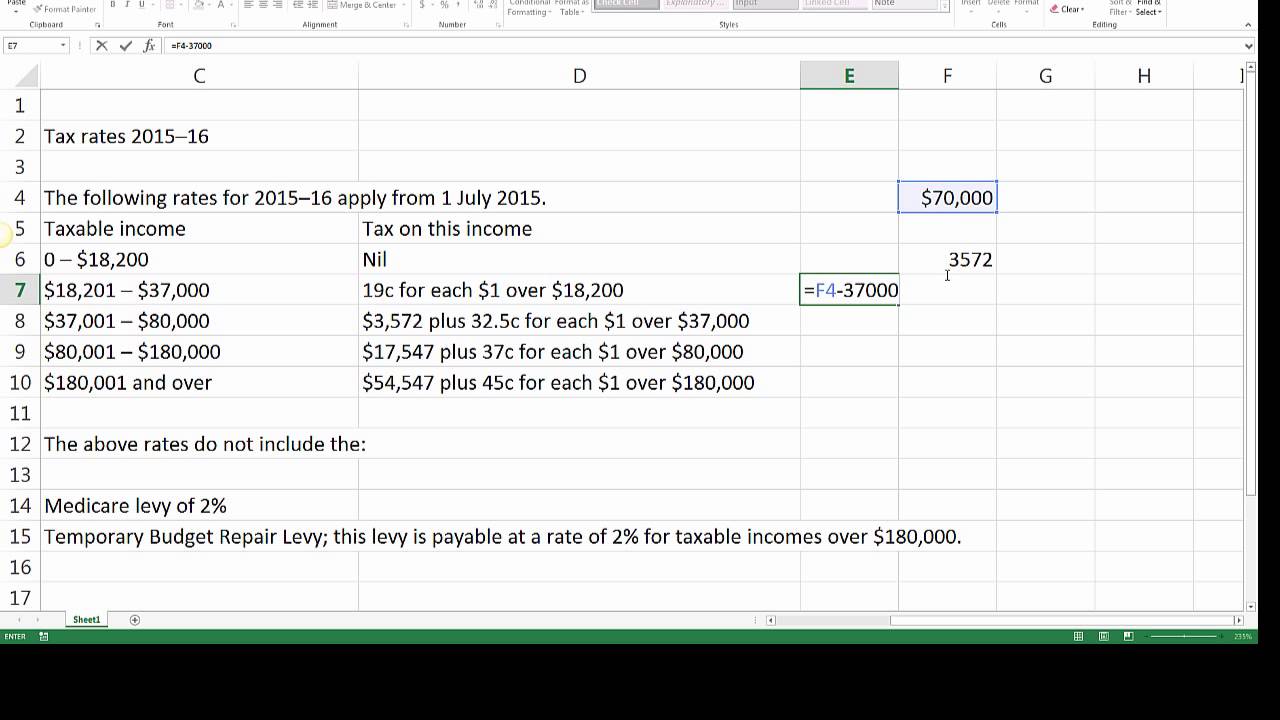

Simply select the appropriate tax year you wish to include from the Pay Calculator. The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Subtract any deduction calculated on your Australian taxable wages from your total Queensland taxable wages then multiply this amount by the applicable payroll tax rate.

This calculator is an estimate. If the mode occurs at least 13 of the time we use this as the wage payment amount. 108000 Low And Middle Income Tax Offset.

This Calculator will display. This Calculator is developed for Australians to estimate their possible redundancy payment entitlements tax on redundancy payout and net after tax redundancy pay. The Pay Calculator calculates base pay rates allowances and penalty rates including overtime.

In order to calculate the salary after tax we need to know a few things. If not the calculator compares the median and the mean. 5 rader Brisbane influenced data the most obviously but heres the most popular pay calculations in.

To help you find the information you need wed like to know if you are an employee or an employer. Each calculator provides the same analysis of pay but is simplified to allow you to enter your Australia salary based on how you are used to being paid hourly daily etc. Annual Gross Pay Annual Take Home Pay Effective Tax Rate.

Below is a list of what to include and exclude when calculating ordinary gross wages for your workers. Why this PAYG Calculator. Your gross salary - Its the salary you have before tax.

It also changes your tax code. Take Home Pay Week. If you have HELPHECS debt you can calculate debt repayments.

If the mean is within 5 of the median we use the greater amount as the wage payment. To enter your time card times for a payroll related calculation use this time card calculator. First aid shift on call leading hand refuse collection and.

If the median and the mean differ by more than 5 we use the median as the wage payment. Finally Your Take Home Pay after deducting Income Tax and Medicare. Calculate gross pay before taxes based on hours worked and rate of pay per hour including overtime.

To use this Tax Calculator you need to input your Gross Annual Income or Salary. Superannuation is paid by your employer into your fund in addition to your wage. Select a specific Australia tax calculator from the list below to calculate your annual gross salary and net take home pay after deductions.

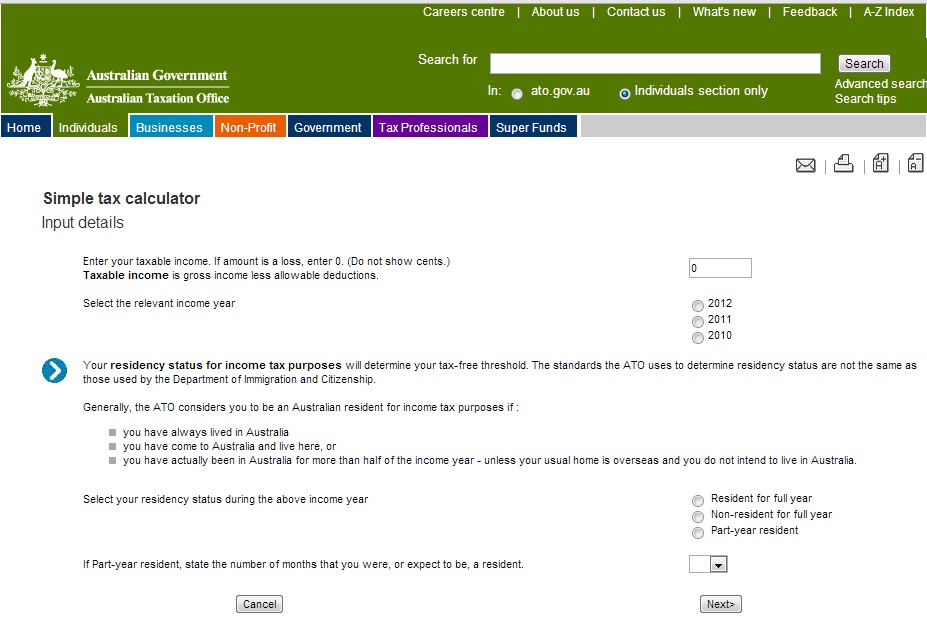

PayCalculator is also available in the App Store. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. It can be used for the 201314 to 202021 income years.

Your Adjusted Taxable Income is 60000 Low Income Tax Offset LITO of up to 100 and a Low And Middle Income Tax Offset LMITO of up to 1080 This calculator is an estimate. If you are a member of the Swedish Church - The church fee varies between 1-15 of your salary. If you dont qualify for this tax credit you can turn this off under the IETC settings.

Calculate Your Pay This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions. Its the tool our Infoline advisers use to answer your enquiries. Gross Pay or Salary.

Where you live - The municipal tax differs between the municipalities. Take Home Pay Gross. Ordinary wages do not include.

Public holiday penalty rates. Income tax on your Gross earnings Medicare Levyonly if you are using medicare Superannuation paid by your employer standard rate is 95 of your gross earnings. Gross pay is the total amount of money you get before taxes or other deductions are subtracted from your salary.

Values less than or equal to 1000 will be considered hourly. It also provides you with your Net yearly monthly fortnightly and weekly salary. How to calculate the net salary.

Reverse Tax Calculator Net To Gross

Australia 125000 Salary After Tax Australia Tax Calcu

How To Calculate Payg Tax In Australia Tax Withheld Youtube

What Is A 1099 Form And How Do I Fill It Out Bench Accounting In 2020 Irs Forms Tax Forms 1099 Tax Form

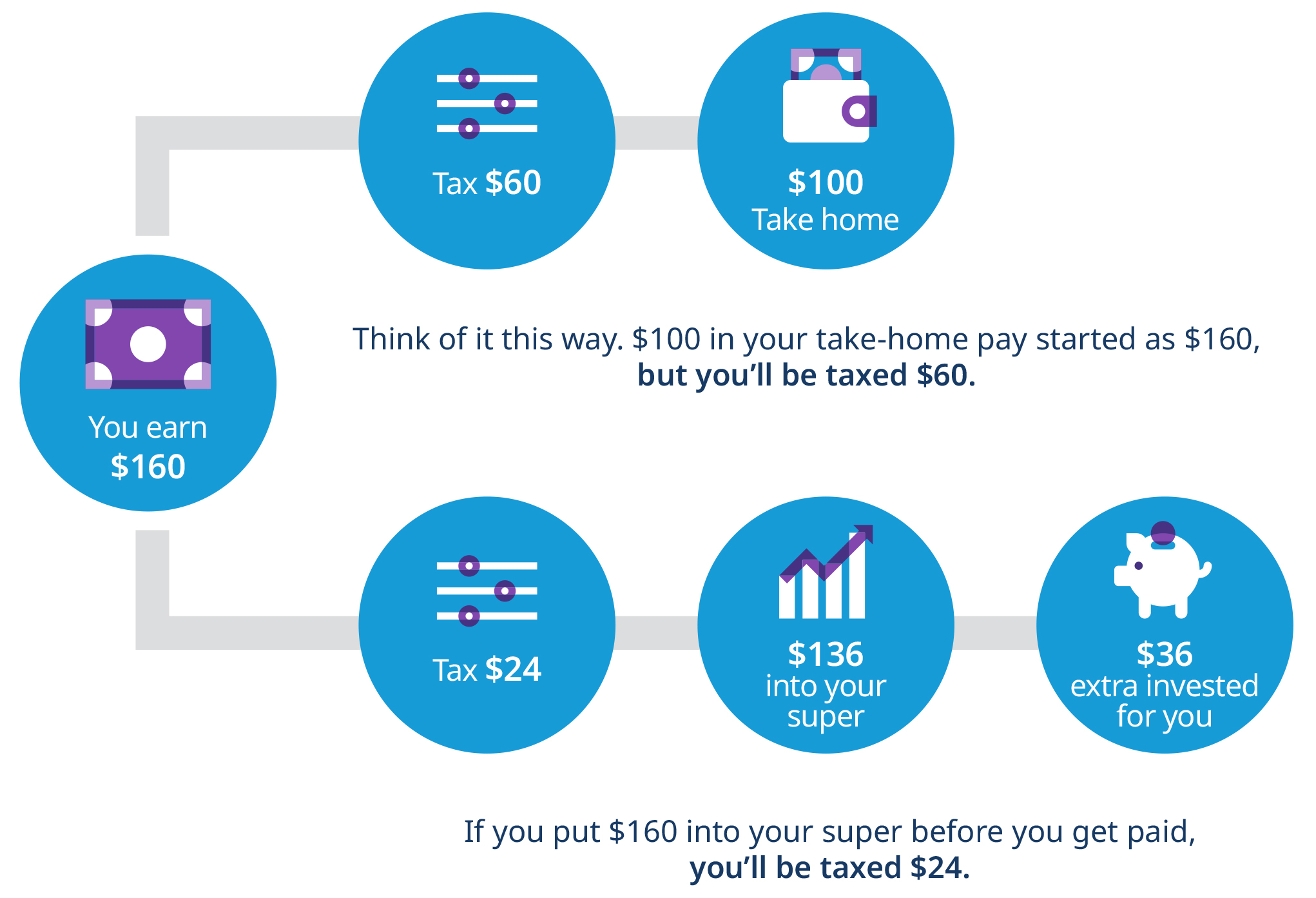

Upgrade Your Future With Salary Sacrifice Mercer Financial Services

Free Employee On Cost Calculator Pay Calculator Tool Australia

How To Calculate The Net Salary From Gross In Portugal Lisbob Salary Portugal Calculator

32 Free Invoice Templates In Microsoft Excel And Docx Formats Invoice Template Invoice Sample Invoice Template Word

Income Gross Up Calculator Peard

Regional Australia Bank Tools Income Tax Calculator

Au Income Tax Calculator July 2021 Incomeaftertax Com

Ytd Calculator And What Is Year To Date Income Calculator

50 Top Weirdest Foods From All Over The World Bizarre Foods Weird Food Food

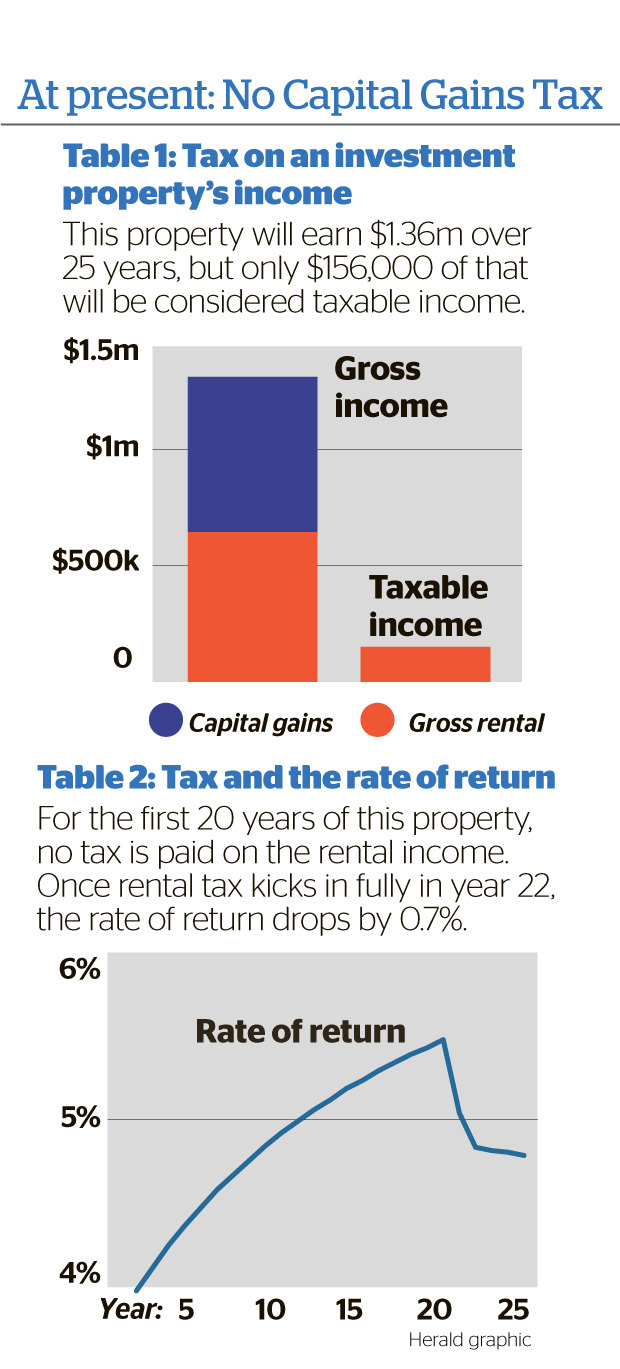

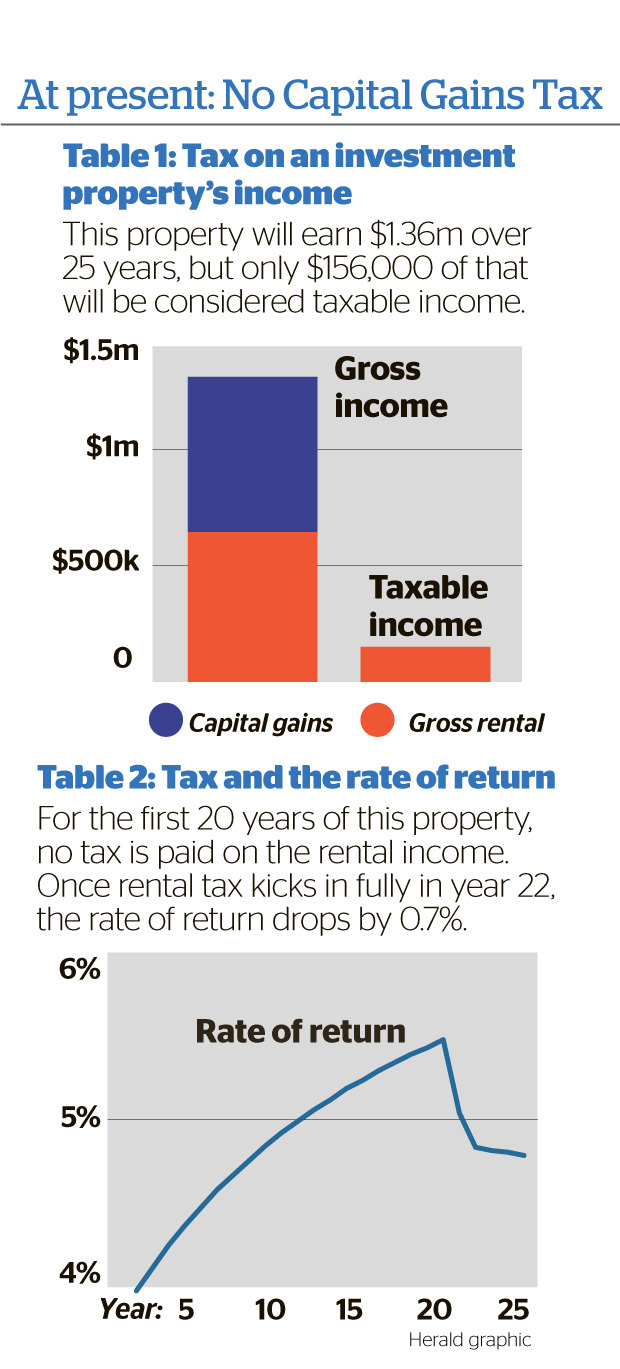

How Much Tax Do Property Investors Really Pay Nz Herald

Reverse Tax Calculator Net To Gross

Calculating Payroll Accrual Percentages Australia Only Support Notes Myob Accountedge Myob Help Centre

Post a Comment for "Gross Pay Calculator Qld"