Gross Income Calculator Uk From Net

Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. The latest budget information from April 2021 is used to show you exactly what you need to know.

Paycheck Calculator Take Home Pay Calculator

Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear.

Gross income calculator uk from net. To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. The answer is to use this tool our Reverse Tax Calculator. If 160 is received after the basic rate income tax of 20 has been deducted the grossed-up figure is as follows.

We offer you the chance to provide a gross or net salary for your calculations. Multiply the net amount received by the grossing-up fraction. An employer subtracts these taxes from the gross salary as part of its payroll calculations.

Use our net pay calculator to work out your monthly take-home pay as a contractor or permanent employee. Calculate your monthly net pay based on your yearly gross income with our salary calculator. The grossing-up fraction is 100 divided by 100 less the rate of tax.

Accurate fast and user friendly UK salary calculator using official HMRC data. First 2000 from dividends is also tax-free. Same with the first 5000 from savings interest although it can be less it depends on your tax band.

Income tax calculator. Simply enter your annual or monthly income into the salary calculator above to find out how UK taxes affect your income. Salary Before Tax your total earnings before any taxes have been deducted.

Through a system called Pay As You Earn PAYE the employer then remits the tax directly to HMRC on behalf of the employee. 292 rader Calculate net pay based on gross salary income and the municipality you live in. Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to.

Please note where a net salary has been agreed the employer will be covering the employees pension contribution in addition to their own. Also known as Gross Income. Enter your annual monthly or weekly income to work out your estimated gross to net earnings after tax and pension contributions and more easily decide which working arrangement might be better for you and your family.

Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans. Use the calculator to work out an approximate gross wage from what your employee wants to take home. We strongly recommend you agree to a gross salary.

Net salary is calculated when income tax and national insurance contributions have been deducted from the gross salary. Everyone in the UK is entitled to 12500 tax-free income this is called the Personal Allowance. If you made any capital gains sold shares property etc the first 12000 is tax-free.

Calculate your take-home pay given income tax rates national insurance tax-free personal. How do you find the gross salary from the actual money you need to spend. Using an estimation system to take into consideration every option available on the regular tax calculator including self employmentCIS options we can find the gross figure from a net figure provided.

Net Salary Calculator 2020 10855 KB Excel Please note. You will see the costs to you as an employer including tax NI and pension contributions. Updated for the 2021-2022 tax year.

Use the calculator to work out what your employee will take home from a gross wage agreement. Hourly rates weekly pay and bonuses are also catered for. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly.

Use our net pay calculator to calculate your net income. The calculation is as follows. Youll then get a breakdown of your total tax liability and take-home pay.

Calculations for tax are based on a tax code of S1250L If you are based outside the UK you should contact the Direct Tax Team for more information on your take home pay as you may be subject to overseas tax regulations. It can be used for the 201314 to 202021 income years. Why not find your dream salary too.

21 rader Your net wage is found by deducting all the necessary taxes from the gross salary. Gross annual income - Taxes - CPP - EI Net annual salary. Our salary calculator will provide you with an illustration of the costs associated with each employee.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Find out your take-home pay - MSE. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance.

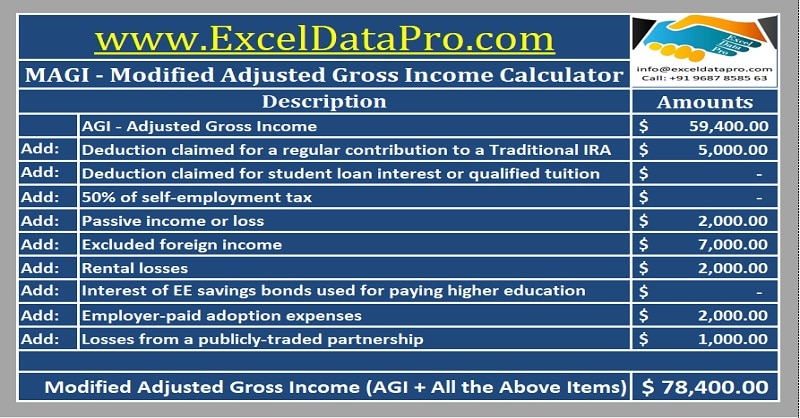

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

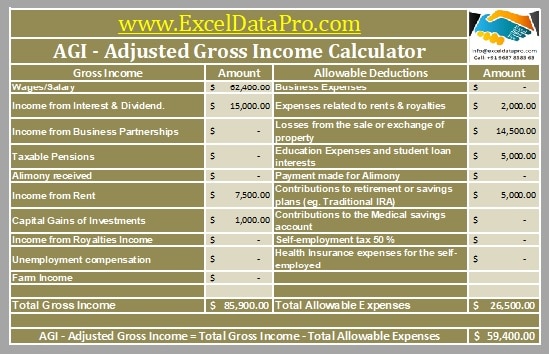

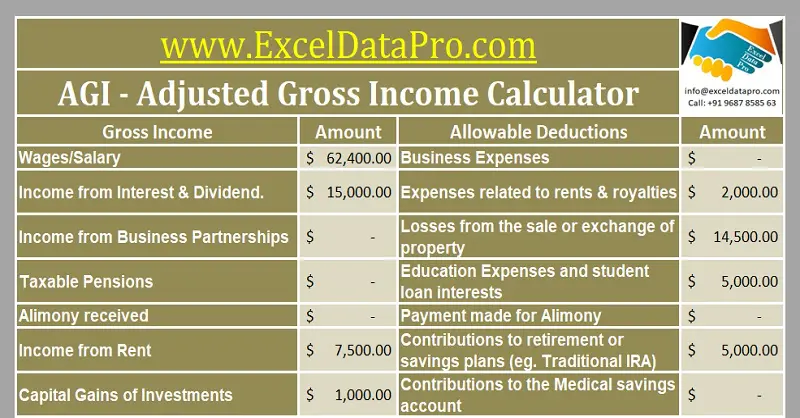

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Nannyplus Tax Table 2017 18 Nanny Nanny Agencies North West

Calculating Gross Pay Worksheet Financial Literacy Worksheets Student Loan Repayment Worksheet Template

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

3 Ways To Work Out Gross Pay Wikihow

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Paycheck Calculator Take Home Pay Calculator

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Taxable Income Formula Examples How To Calculate Taxable Income

Annual Income Learn How To Calculate Total Annual Income

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Taxable Income Calculator India Income Business Finance Investing

50 000 After Tax 2021 Income Tax Uk

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

72 000 After Tax Salary Uk Is 49 086 Tax Income Tax Salary

Excel Payroll Calculator Template Software Download Payroll Template Excel Spreadsheets Templates Payroll

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Post a Comment for "Gross Income Calculator Uk From Net"