Take Home Salary Uk 90000

This equates to 5074 per month and 1171 per week. By default the calculator selects the current tax year but you can.

Pin On Make Money Online Side Hustles

Use this calculator to find exactly what you take home from any salary you provide.

Take home salary uk 90000. How to use the Take-Home Calculator. Your employer collects this through PAYE and pays it over to HMRC on your behalf. Earning 100000 a year isnt going to change that Indeed the cost of living in some parts of the country means that the sum is barely enough to fund a loan to purchase a.

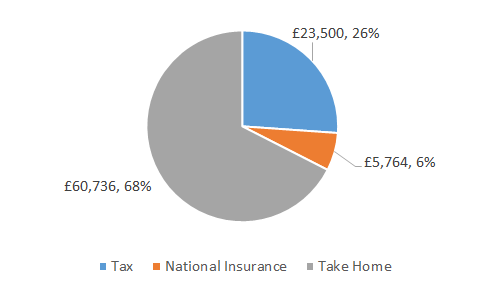

For the 2019 2020 tax year 90000 after tax is 60736 annually and it makes 5061 net monthly salary. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

What is the Cost of Employment for an Employee of a 9000000 Salary in the UK. If you earn 90000 in a year you will take home 60840 leaving you with a net income of 5070 every month. If you work 5 days per week this is 234 per day or 29 per hour at 40 hours per week.

Based on a 40 hours work-week your hourly rate will be 4328 with your 90000 salary. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. The total cost of employment for an employee on a 9000000 Salary per year.

This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment. HMRC will deduct in tax and in National Insurance from your salary thats 0 total deductions and your full yearly take-home will be. We have redesigned this tool to be as easy to use as possible whilst maintaining the level of accuracy you expect from our selection of tax tools.

On a 90000 salary your take home pay will be 60889 after tax and National Insurance. 90000 after tax and National Insurance will result in a 5070 monthly net salary in 2019 leaving you with 60840 take home pay in a year. Guide to getting paid Our salary calculator indicates that on a 90000 salary gross income of 90000 per year you receive take home pay of 60889 a net wage of 60889.

You will pay a total of 23500 in tax this year and youll also have to pay 5660 in National Insurance. This is 507398 per month 117092 per week or 23418 per day. If you earn an annual gross salary of 90k in the UK after income tax and national insurance deducted take home pay makes 5018 monthly net salary.

If you earn 90000 a year then after your taxes and national insurance you will take home 60840 a year or 5070 per month as a net salary. This calculator is intended for use by US. Your Income vs UK Average Salary.

If you earn an annual gross salary of 13k in the UK after income tax and national insurance deducted take home pay makes 1018 monthly net salary. If your income is 90000 90k a year your after tax take home pay would be 6088776 per year. 75000 76000 77000 78000 79000 80000 81000 82000 83000 84000 85000 86000 87000 88000 89000 90000 91000 92000 93000 94000 95000 96000 97000.

63 of your income is taxed as national insurance 568024 per year. To use the tax calculator enter your annual salary or the one you would like in the salary box above. UK Take Home Pay Calculator.

The total tax you owe as an employee to HMRC is 29111 per our tax calculator. Annual Gross Monthly Gross. It can also be used to help fill steps 3 and 4 of a W-4 form.

The latest budget information from April 2021 is used to show you exactly what you need to know. Why not find your dream salary too. You earn 28028 less than the.

If you earn a year in 1 after tax deductions youll take home a net salary of every month and your hourly rate will be. Hourly rates weekly pay and bonuses are also catered for. Find out the benefit of that overtime.

Youll pay 260 of your income as tax This means the tax on your 90000 per year salary is 2343200. Annual take-home pay breakdown 9000000 Net Income. Calculate your take home pay with our interactive and accurate.

Now lets see more details about how weve gotten this monthly take-home sum of 5070 after extracting your tax and NI from your yearly 90000 earnings. The wage can be annual monthly weekly daily or hourly - just be sure to configure the calculator with the relevant frequency. To find out your take home pay enter your gross wage into the calculator.

Marnie Smarketzy Has Created A Short Video On Tiktok With Music Money Amended I Usually Do This At The Start Of Th In 2021 Short Videos Social Media Manager Music

Https Www Reed Co Uk Tax Calculator 90000

Which Physician Specialties Are Happiest With Their Choice Http Blog Sermo Com 2014 03 10 Physicians Would Choose The Family Medicine Psychiatry Oncology

90 000 After Tax Ie Breakdown July 2021 Incomeaftertax Com

That S Why Silicon Valley Is Occupied By Chinese And Indians Psychology College Psychology Major

Tax Calculator For 90 000 Take Home Pay Calculator Reed Co Uk

Father S Day Video In 2021 Happy Fathers Day Happy Father Happy

Parallax Scrolling Is A Special Scrolling Technique In Computer Graphics Wherein Background Images Move By The Camera Slowe Design Web Design Design Resources

Fashion Designer Companies Fashion Designer Salary Fashion Designer Logo Women

Income Tax Calculation Formulas Excel How To Memorize Things Printable Worksheets Worksheets

90 000 After Tax 2021 Income Tax Uk

Veer Camo Cruiser Sidewall Kit Spanish Style Homes Beach Signs Wooden French Cottage

Balloon Pergola Urban Art Installation Balloon Art Street Art

Pin On Earn Money From Internet At Home

Not Sure What To Do To Get More People Reading Your Blog Posts Try Adding Your Links To These Websites After Publishing Blog Marketing Blogging Tips Blog Tips

Land Grabbing Mannar Vavuniya Landing

Post a Comment for "Take Home Salary Uk 90000"