In Hand Salary Calculator Usa Texas

Using the United States Tax Calculator. Why not find your dream salary too.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

In hand salary calculator usa texas. Calculate your Texas net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Texas paycheck calculator. Understand from below how do we exactly calculate the In-hand or Take home salary. The PaycheckCity salary calculator will do the calculating for you.

The latest budget information from April 2021 is used to show you exactly what you need to know. Using our Texas Salary Tax Calculator To use our Texas Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Superannuation is part of your wage salary package and paid into your Superannuation fund.

Hourly rates weekly pay and bonuses are also catered for. Overview of Texas Taxes Texas has no state income tax which means your salary is only subject to. Low Income Tax Offset LITO of up to 100 and a Low And Middle Income Tax Offset LMITO of up to 1080.

The average salary for a Ranch Hand is 1278 per hour in Texas. Explore the cost of living and working in various locations. The average annual pay for a Rig Hands Job in Texas is 68487 a year.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. This calculator is an estimate. Learn about salaries benefits salary satisfaction and where you could earn the most.

Dont want to calculate this by hand. Your Adjusted Taxable Income is 60000. The Texas Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and Texas State Income Tax Rates and Thresholds in 2021.

Find apply for and land your dream job at your dream company. Details of the personal income tax rates used in the 2021 Texas State Calculator are published below the calculator this. How much do Rig Hands jobs pay a year.

Subtract any deductions and payroll taxes from the gross pay to get net pay. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is. First enter your Gross Salary amount where shown.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Texas. Calculate your value based on your work experience and skill set. Please note that our salary calculator is calculating this for FY 2020-21 Current Financial Year.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

After a few seconds you will be provided with a full breakdown of the tax you are paying. 3 Farm Hand Salaries in Texas US provided anonymously by employees. Your average tax rate is 169 and your marginal tax rate is 297This marginal tax rate means that your immediate additional income will be taxed at this rate.

If you are filing taxes and are married you have the option to file your taxes along with your partner. If you make 55000 a year living in the region of Texas USA you will be taxed 9295That means that your net pay will be 45705 per year or 3809 per month. What salary does a Farm Hand earn in Texas.

Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay. Can be used by salary earners self-employed or independent contractors. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Cost of Living Calculator. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Texas Salary Paycheck Calculator. Using the United States Tax Calculator is fairly simple. For previous years the values would change.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. This number is the gross pay per pay period. Next select the Filing Status drop down menu and choose which option applies to you.

Take-Home Salary is the total salary that an employee gets after all necessary deductions are made. Use the salary calculator above to quickly find out how much tax you will need to pay on your income.

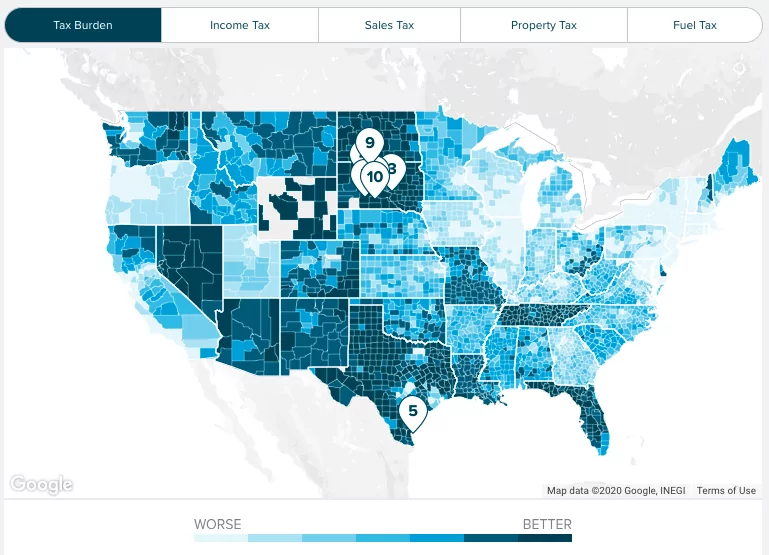

Texas Income Tax Calculator Smartasset

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Loan Advisors 714 271 8524 Reverse Mortgage Mortgage Loans Mortgage

Project Share For Texas Teachers Texas Teacher Teachers Mathematics

إدارة معلومات الطاقة ترفع تقديرات أسعار النفط في العام المقبل من سالي إسماعيل مباشر أبقت إدارة معلومات الطاقة Oil And Gas Crude Oil Refinery

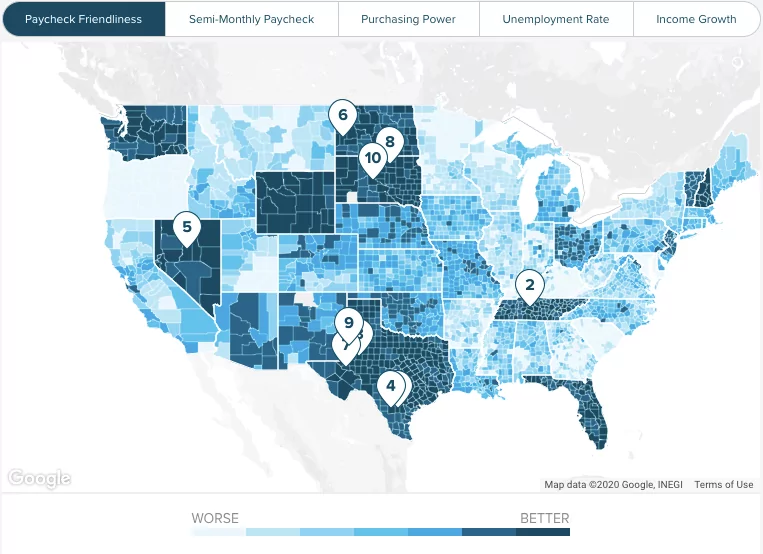

Texas Paycheck Calculator Smartasset

Health Insurance Marketplace Calculator Kff

Texas Income Tax Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Pin By John Smith On Arlington Tx Water Park Summer Field Trips Family Friendly Hotels

Llc Tax Calculator Definitive Small Business Tax Estimator

Payslip Templates 28 Free Printable Excel Word Formats Templates Words Repayment

Texas Income Tax Calculator Smartasset

Texas Paycheck Calculator Smartasset

Iq Mental Age Calculator Age Calculator Psychological Testing Calculator

Texas Paycheck Calculator Smartasset

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Post a Comment for "In Hand Salary Calculator Usa Texas"