Gross Income Calculator Malaysia

Salary Calculator Malaysia with EPF SOCSO EIS PCB MTD Calculate your salary EPF PCB and other income tax amounts online with this free calculator. In terms of growth median income in Malaysia grew by 39 per cent per year in 2019 as compared to 66 per cent in 2016.

T20 M40 And B40 Income Classifications In Malaysia

SERVICES BERHAD 200001003034 505639-K Corporate Office.

Gross income calculator malaysia. Looking forward we estimate Gross National Product in Malaysia to stand at 35931 in 12 months time. The amount computed by adding the basic salary and allowances but without the taxes and other deductions such as EPF and Socso. Calculate your income tax social security and pension deductions in seconds.

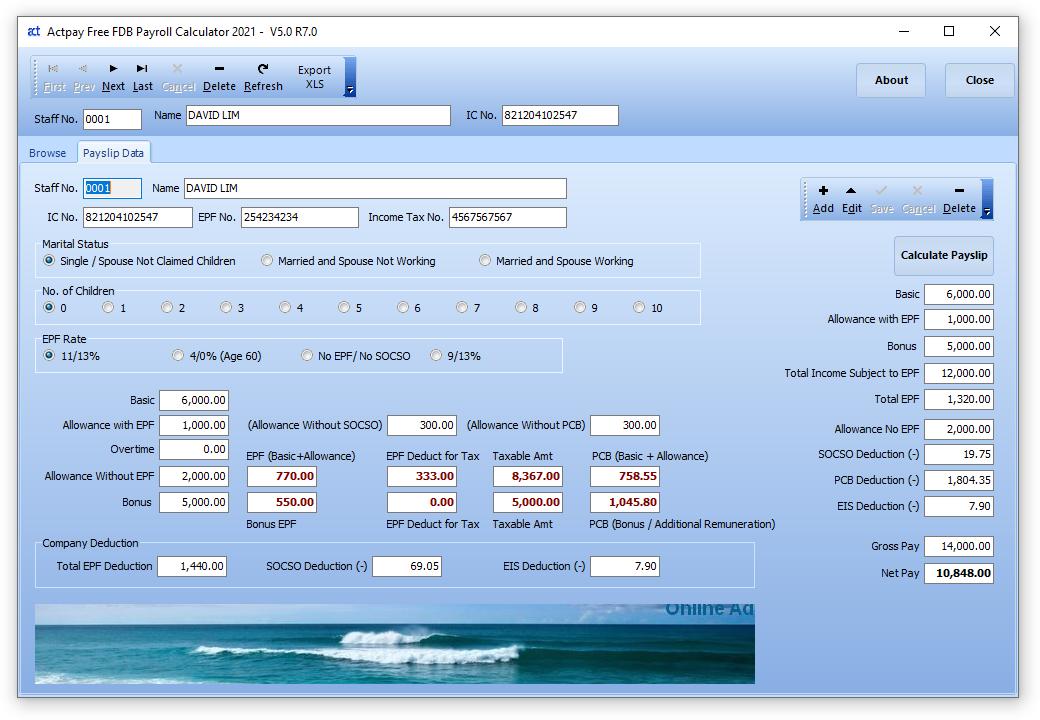

Hourly Gross Pay is calculated by multiplying the number of hours worked in the pay period times the hourly pay rate. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Malaysia tax calculator and change the Employment Income and Employment Expenses period. The PCB calculator 2021 in Actpay is approved by LHDN Malaysia and has 100 calculation accuracy verified repeatedly over the last 5 years.

In 2019 average monthly household income is RM7901. In 2019 average monthly household expenditure is RM4534. Summary report for total hours and total pay.

In 2019 mean income in Malaysia was RM7901 while Malaysias median income recorded at RM5873. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more.

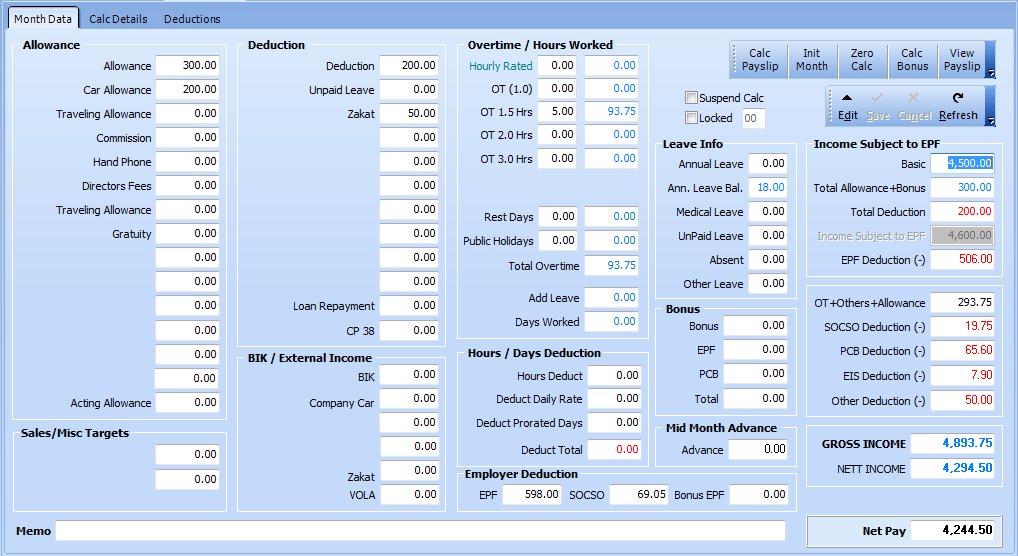

Any individual earning a minimum of RM34000 after EPF deductions must register a tax file. Input the Basic Salary Allowances Deductions and Overtime to calculate the gross salary. In 2019 Kuala Lumpur recorded the highest median monthly household income with RM10549.

For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. It should be noted that this takes into account all your income and not only your salary.

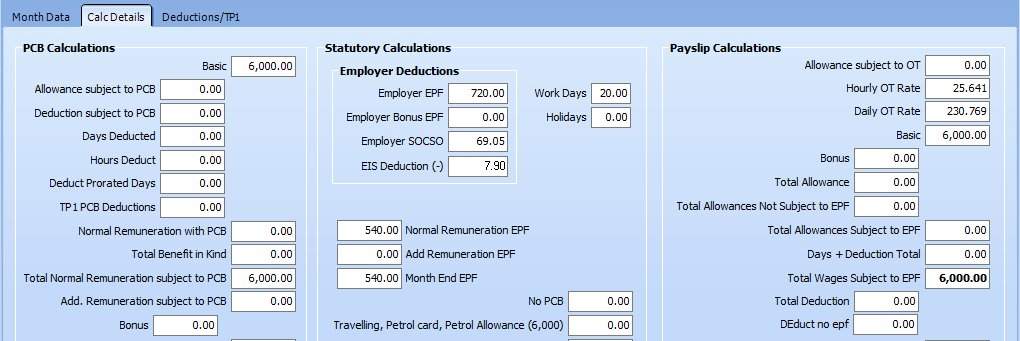

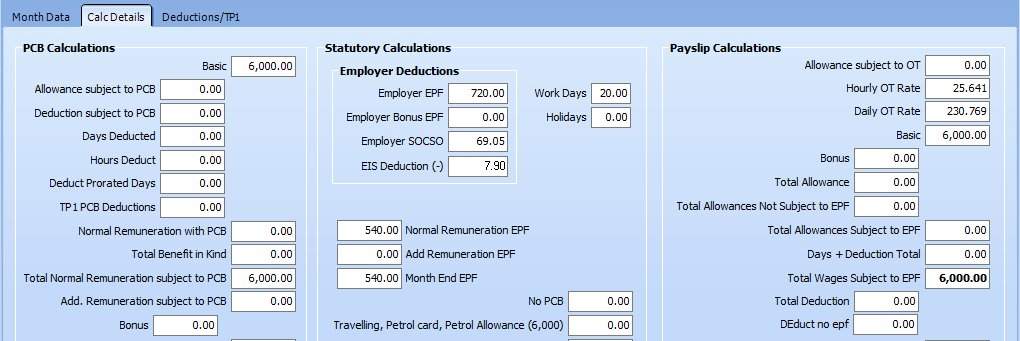

MY Income Tax Calculator 2020. In this article we will go through the computerised method to calculate PCB accurately in four steps. Firstly fill in the values for the following employee information.

For example when an employer pays an employee a monthly salary of RM4000 this means the employee has earned RM4000 in gross salary. Who needs to file income tax. This is the amount of salary you are paid.

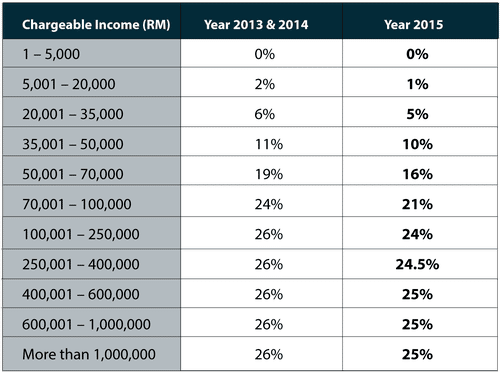

This is based on the number of days spent in Malaysia. VOLA is living accommodation provided for an employee by his employer. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Defined value of the living accommodation usually the market rent. One of a suite of free online calculators provided by the team at iCalculator. The value of the benefit is to be treated as gross income from employment of payroll calculator malaysia.

Gross Annual Income RM. For a monthly-rated employee the gross rate of pay for 1 day is calculated as follows. The Malaysia tax calculator assumes this is your annual salary before tax.

In the long-term the Malaysia Gross National Income is projected to trend around 39198 MYR Billion in 2022 and 41158 MYR Billion in 2023 according to our econometric models. If you want to take a closer look at your annual income and tax MY Income Tax Calculator is another free app for Android users. Same with other apps it also calculates your monthly deductions once you type in your monthly gross salary.

Overtime pay is also included in the gross pay calculation. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers. Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2021.

The gross salary and statutory deductions are then used to calculate. The general rule is that VOLA is calculated for payroll calculator as follows. Recall employees status and information.

This translates to roughly RM2833 per month after EPF deductions or about RM3000 net. Department of Statistics Malaysia Official Portal. Calculate the gross amount of pay based on hours worked and rate of pay including overtime.

Level 43A MYEG Tower Empire City No 8 Jalan Damansara PJU 8 47820 Petaling Jaya Selangor. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Calculate you Monthly salary after tax using the online Malaysia Tax Calculator updated with the 2021 income tax rates in Malaysia.

Household Income Basic Amenities Survey Report 2019. This app also provides a summary of your annual tax and taxable income. Moreover mean income rose at 42 per cent in 2019.

If you earn a nett after deducting EPF KWSP and income taxes of RM5000 a month your Gross Annual Income is RM60000 RM5000 x 12. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make sure you. The system is thus based on the taxpayers ability to pay.

Gross includes bonuses overtime pay holiday pay etc. If youre still not sure how to calculate it you can use this tool here. 12 monthly gross rate of pay 52 average number of days an employee is required to work in a week.

Free Payroll Software For Sme S Malaysia

Bonus Plan Template Excel Fresh Excel Template For Pcb Bonus Calculation How To Plan Payroll Template Business Plan Template

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

How To Calculate Growth Rate Growth Math Equations Calculator

The Complete Personal Income Tax Guide 2014 Infographic Tax Guide Income Tax Income

What You Need To Know About Income Tax Calculation In Malaysia

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Malaysia Income Tax Guide 2016

Mrta Vs Mlta Which Do You Need Investment Property Do You Need Survival Tips

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Malaysia 2014 Economy Outlook Infographics Alchohol Infographic Outlook

Malaysian Bonus Tax Calculations Mypf My

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

How To Sell Online Payslips To Your Employees Payroll Things To Sell Payroll Template

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

How To Calculate Adjusted Gross Income Agi For Tax Purposes Adjusted Gross Income Health Savings Account Tax Accountant

Post a Comment for "Gross Income Calculator Malaysia"