Gross Income Calculator Hawaii

Hawaii General Excise Tax is an additional tax totally in addition to federal and state income tax on the gross income of most Hawaii businesses and other activities. On a gross salary of 299730 you will have a net salary of around 18436616 in Hawaii and between 18101363 and 21147306 if you were to file in another state.

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Do I also have to pay Hawaii income tax.

Gross income calculator hawaii. Monthly Gross Income from all sources. Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income. Hawaii implemented this tax in place of sales tax which is imposed by most other states.

The Hawaii Salary Calculator allows you to quickly calculate your salary after tax including Hawaii State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Hawaii state tax tables. Hawaii Income Tax 10. SalaryWage and taxes in Latvia.

Enter the following information regarding each parents income. Calculating your Hawaii state income tax is similar to the steps we listed on our Federal paycheck calculator. You can use our free Hawaii income tax calculator to get a good estimate of what your tax liability will be come April.

Our Hawaii State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 8000000 and go towards tax. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. Taxable Income in Hawaii is calculated by subtracting your tax deductions from your gross income.

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Your net income is the profit remaining after you deduct allowable business expenses from your gross income. SalaryWage and Tax Calculator - Estonia Latvia This website may use cookies or similar technologies to personalize ads interest-based advertising to provide social media features and to analyze our traffic.

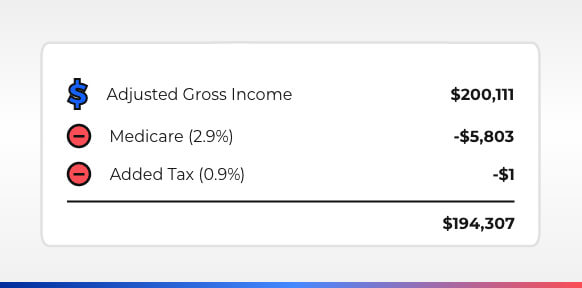

Summary report for total hours and total pay. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. While this calculator can be used for Hawaii tax calculations by using the drop down menu provided you are able to.

Overview of Hawaii Taxes Residents of the beautiful volcanic islands of Hawaii are subject to a variable income tax system that features 12 tax brackets. Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Hawaii paycheck calculator. However you will only pay income tax on your net income.

23 rader Living Wage Calculation for Hawaii. Hopefully this guide has helped you to understand your salary and the federal and state taxes you need to pay on it. Figure out your filing status.

Monthly Net Income from Table of Incomes Add together to get the total income. Free online gross pay salary calculator plus calculators for exponents math fractions factoring plane geometry solid geometry algebra finance and more. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Use this free Hawaii Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Its very similar but not exactly so to a common state sales tax. In most cases if you are doing business in Hawaii then you must pay both GET and Hawaii income tax.

The tool provides information for individuals and households with one or two working adults and zero. Figure out the percentage for each parent by dividing each parents monthly net income by the total income. Using our Hawaii Salary Tax Calculator To use our Hawaii Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. It determines the amount of gross wages before taxes and deductions that are withheld given a specific.

The Hawaii tax calculator is designed to provide a simple illlustration of the state income tax due in Hawaii to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202122 tax reform calculator. Use this Hawaii gross pay calculator to gross up wages based on net pay. One of a suite of free online calculators provided by the team at iCalculator.

What is Hawaii GE Tax. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Far too many people fail to allow for the full income tax deduction allowances when completing their annual tax return inHawaii the net effect for those individuals is a higher state income tax bill in Hawaii and a higher Federal tax bill.

Calculate the gross amount of pay based on hours worked and rate of pay including overtime. The assumption is the sole provider is working full-time 2080 hours per year.

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross Pay And Net Pay What S The Difference Paycheckcity

Official Launch Wedding Planner Pricing Guide Wedding Planner Packages Wedding Planning Worksheet Wedding Planning Business

Top 5 Best Salary Calculators 2017 Ranking Top Net Gross Salary Calculators Advisoryhq

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

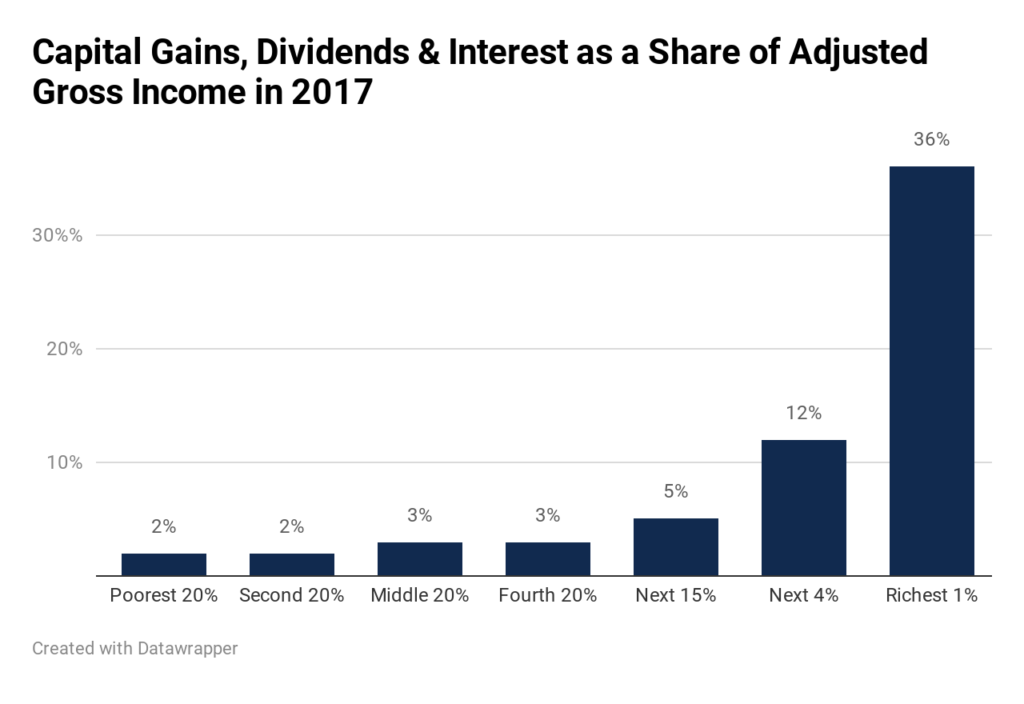

The Latest Wildly Misleading Argument Against Taxing The Rich Itep

Pin On Business Tax Deductions

Joint Venture Real Estate Financial Model The Purpose Of This Financial Model Is To Give Investors And Sponso Business Model Canvas Joint Venture Real Estate

Gross Pay And Net Pay What S The Difference Paycheckcity

Gross And Net Income Personal Financial Literacy Financial Literacy Anchor Chart Personal Financial Literacy Anchor Chart

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Free Self Employment Tax Calculator Including Deductions

Adjusted Gross Income On W2 Adjusted Gross Income On W2 Adjusted Gross Income Income Income Tax Return

Top 6 Best Gross Income Pay Calculators 2017 Ranking Annual Income Net Monthly Wage Salary Calculations Advisoryhq

Standard Deduction Tax Exemption And Deduction Taxact Blog

Income Statement Template Free Layout Format Income Statement Statement Template Profit And Loss Statement

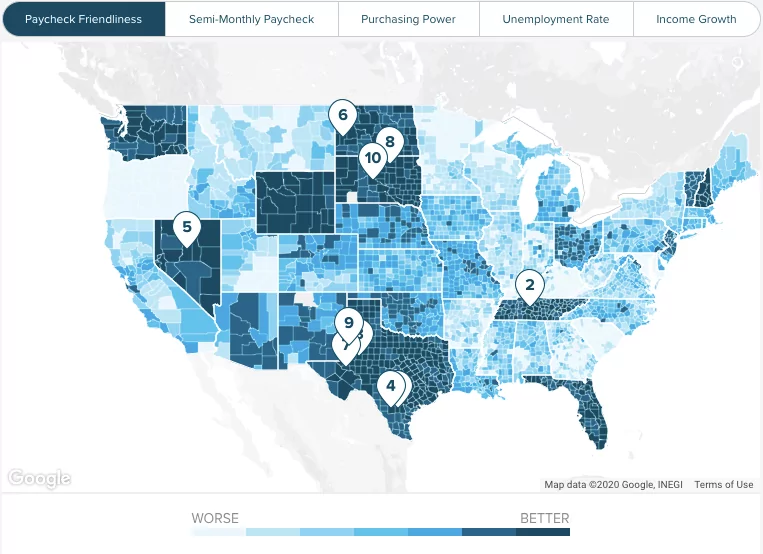

Hawaii Paycheck Calculator Smartasset

Post a Comment for "Gross Income Calculator Hawaii"