Gross Income Calculator Bc

This means that high-income residents pay a higher. Rates used for GST remittance.

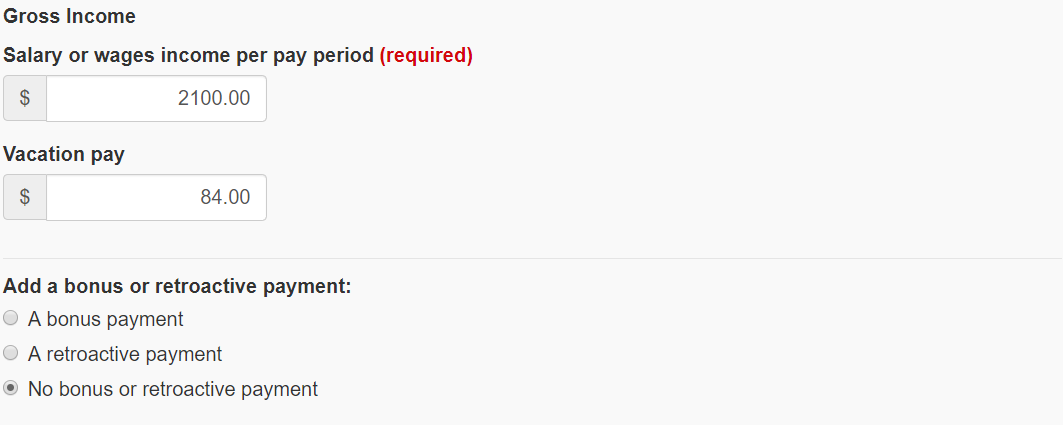

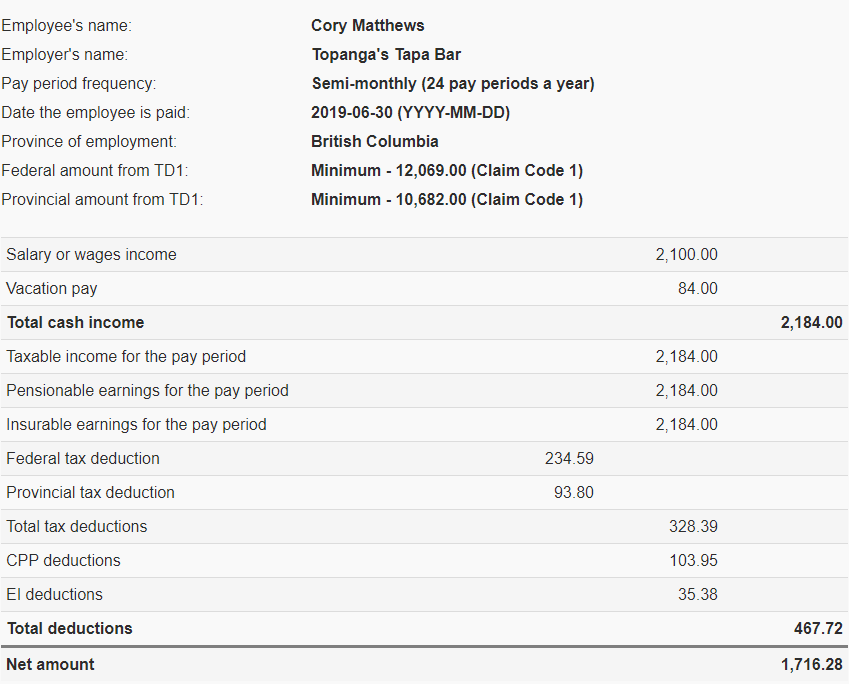

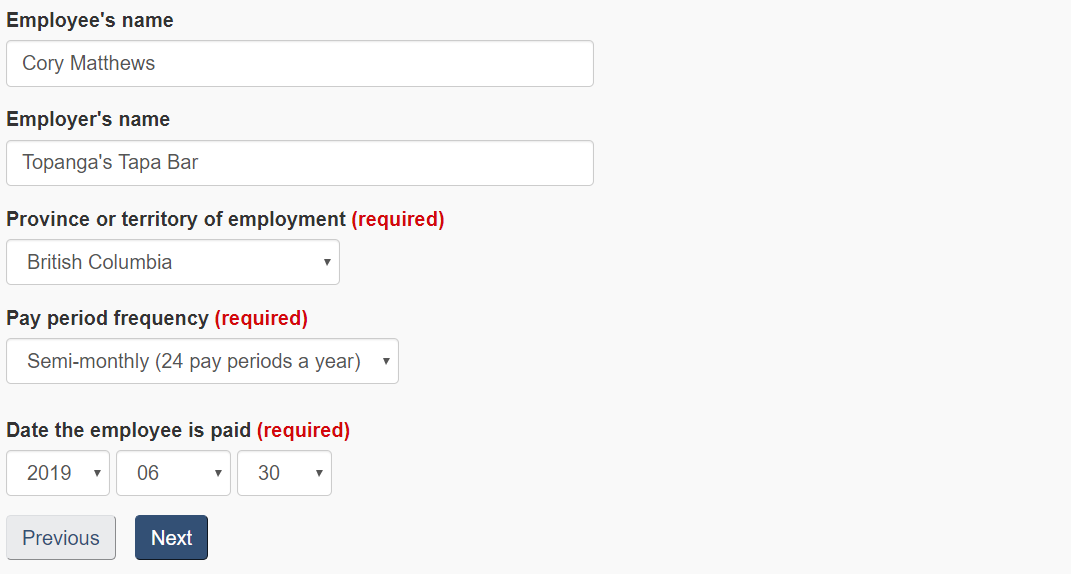

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 10804That means that your net pay will be 41196 per year or 3433 per month.

Gross income calculator bc. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. Your average tax rate is 208 and your marginal tax rate is 338This marginal tax rate means that your immediate additional income will be taxed at this rate. Some money from your salary goes to a pension savings account insurance and other taxes.

Formula for calculating net salary in BC. There are two ways to determine your yearly net income. For retailers and wholesalers 1 in.

Victoria needs to calculate her gross income per month to determine if she can afford it. Trusted by thousands of businesses PaymentEvolution is Canadas largest and most loved cloud payroll and payments service. She inputs her numbers and solves.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include. The British Columbia Income Tax Salary Calculator is updated 202122 tax year. To calculate BC child support the starting point is the income.

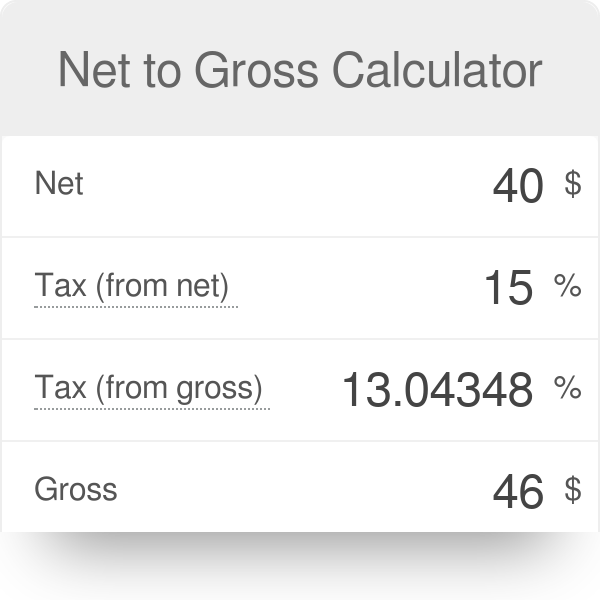

You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period. This British Columbia net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2021. Gross income per month 90000 12.

If you are paid hourly multiply your hourly. Net income is the money after taxation. If children live with only one of their parents only the income of the paying parent is taken into consideration.

Fill the weeks and hours sections as desired to get your personnal net income. The GST remittance standard rate for business with permanent establishment in British-Columbia and supplies 90 or more in province where 5 of GST applies is 36. How to Calculate Child Support in British Columbia.

She decides to use the gross income formula for salary. Formula for calculating net salary in BC. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Child support is calculated using the Federal Child Support Guidelines and gross parental income. Take for example a salaried worker who earns an annual gross salary of 45000 for 40 hours a week and has worked 52 weeks during the year. To Calculate BC BC Child Support Look at the Gross Income not Net.

The annual net income is evaluated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance. Net salary calculator from annual gross income in British Columbia 2021. Gross income per month Annual salary 12.

This is the income that does not include taxes or any other expenses that you can claim against your gross income such as child subsidies etc. Gross annual income Taxes CPP EI Net annual salary. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

45 000 Taxes Surtax CPP EI 35 32939 year net 35 32939 52 weeks 67941 week net 67941 40 hours 1699 hour net You simply need to the. Tax reduction credit gives a non-refundable tax credit of up to 476 in 2020 for individuals with an income below 21185. Gross income per month 7500.

This tax credit is reduced by 356 for income above 21185 meaning that the maximum income that is eligible for the tax reduction credit is 34556. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. 7 rader Easy income tax calculator for an accurate British Columbia tax return estimate.

Net annual salary Weeks of work year Net weekly income. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. This rate applies to income for the year anywhere from April 1st 2013 to 2021 based on the reporting period chosen.

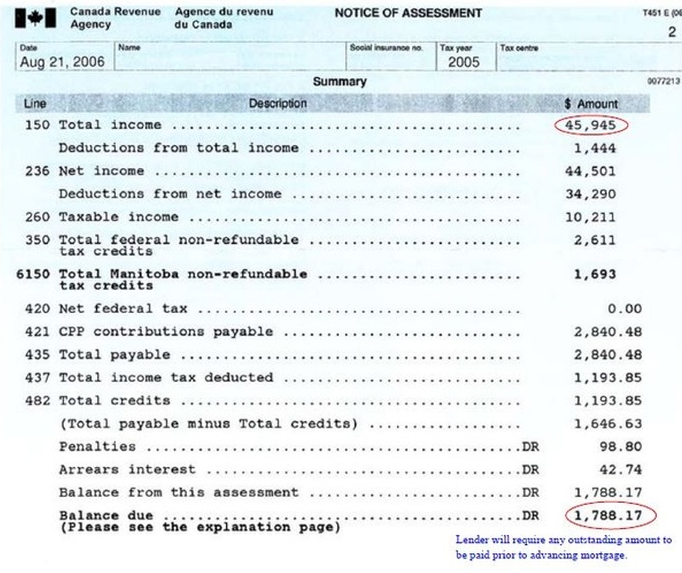

This calculator is based on 2021 British Columbia taxes. Gross income is the income reported on Line 150 of your tax return. Annual net income calculator.

Accountants bookkeepers and financial institutions in Canada rely on us for payroll expertise and payroll services for their clientele. Set the net hourly rate in the net salary section. Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage.

Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income.

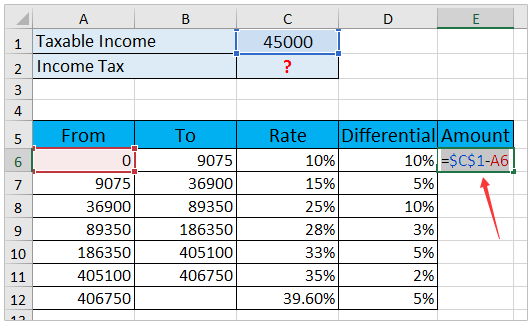

Income Tax Formula Excel University

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Mathematics For Work And Everyday Life

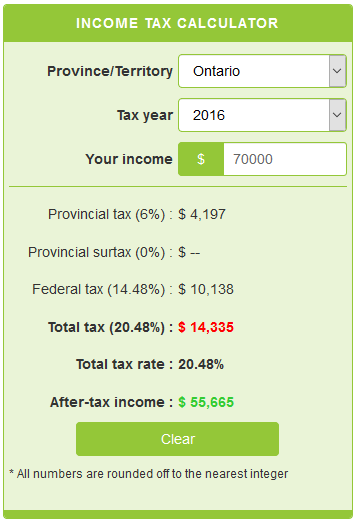

Income Tax Calculator Calculatorscanada Ca

Canada Federal And Provincial Income Tax Calculator Wowa Ca

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

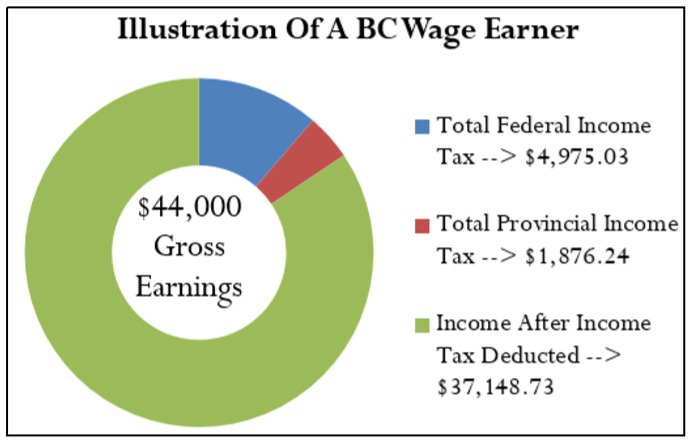

4 2 Personal Income Tax The Taxman Taketh Mathematics Libretexts

Avanti Gross Salary Calculator

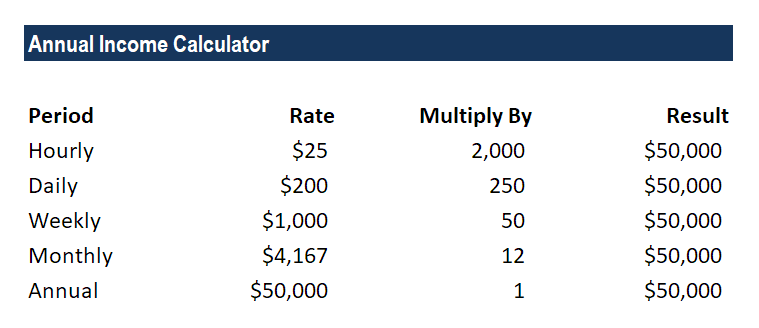

Annual Income Learn How To Calculate Total Annual Income

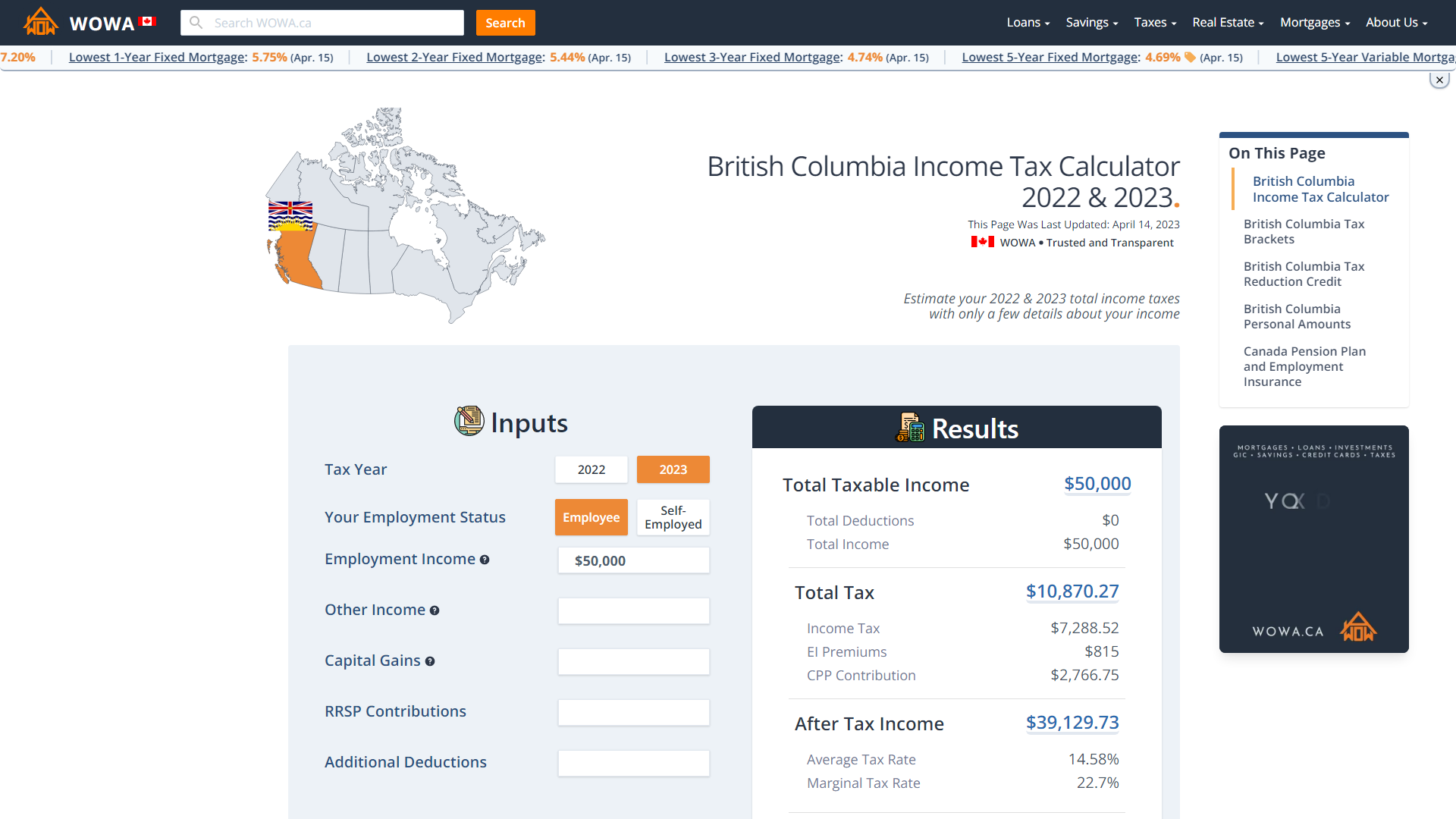

Bc Income Tax Calculator Wowa Ca

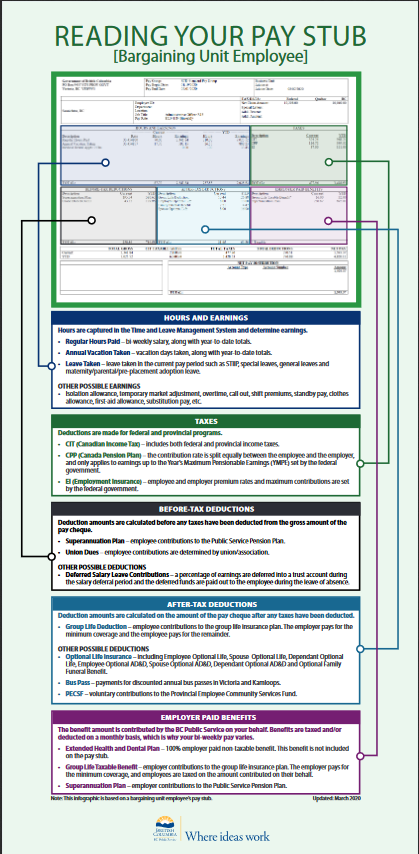

How To Read Your Pay Stub Province Of British Columbia

How To Calculate Income Tax In Excel

Toronto After Tax Income Calculator

Gross Up Add Backs Explained How To Increase Income For A Mortgage

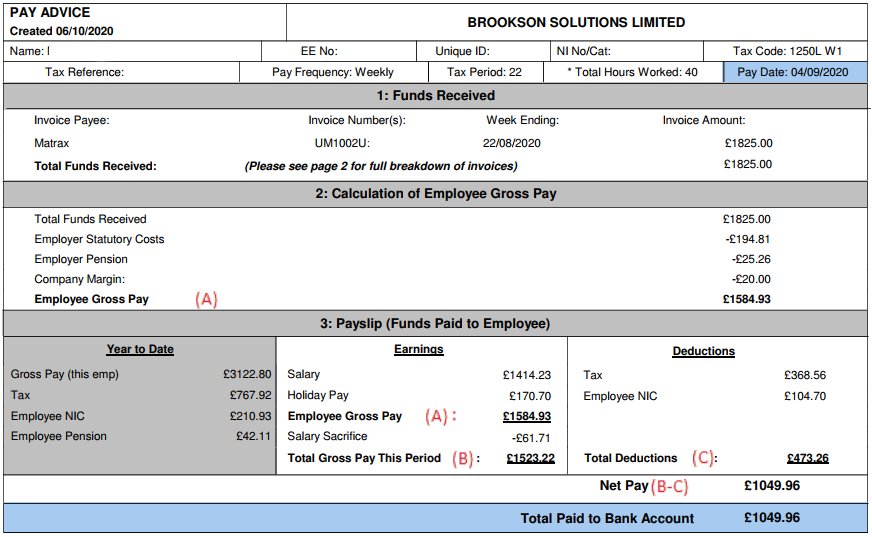

Your Umbrella Payslip Explained Brookson Faq

How To Create An Income Tax Calculator In Excel Youtube

Post a Comment for "Gross Income Calculator Bc"