Adjusted Gross Income Calculation Example

Lets look at an example. If you reported self-employment business income on Schedule C you would include that in your gross income as well.

What Should My Adjusted Gross Income Be

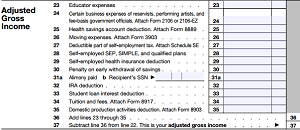

How to Calculate Your AGI To determine your adjusted gross income start with your gross income.

Adjusted gross income calculation example. Tips for Calculating Adjusted Gross Income. Your MAGI is your AGI increased or decreased by certain amounts that are unique to specific deductions. For the tax year 2020 check the line 8b on the form 1040.

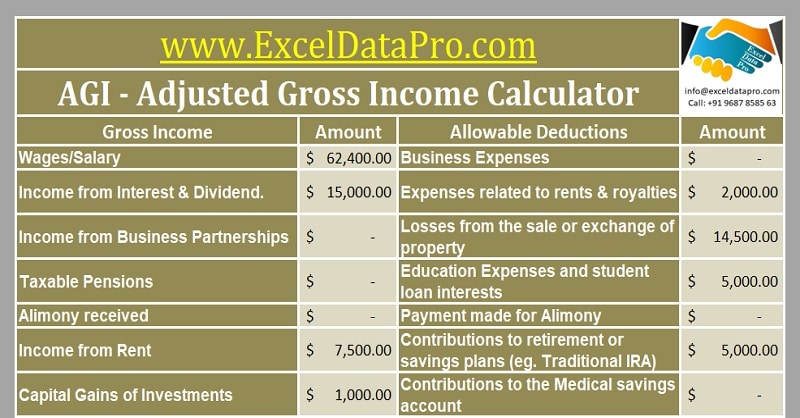

This includes wages interest and dividend income taxable retirement income and capital gains. Adjusted gross income is your taxable income for the year so it is what your income tax bill is based on. She subtracts 4000 from 66800 which is 62800 and her adjusted gross income.

You can determine the value of your adjusted gross income from different lines on various forms. What is your adjusted gross income. The IRS limits some of your personal deductions based on a percentage of your AGI.

His annual allowance for this year will therefore be reduced by 5000 10000 2 to 35000. Your adjusted gross income is the amount of money you receive each month that is subject to taxes. Adjusted Gross Income Adjusted Gross Income AGI is defined as gross income minus adjustments to income.

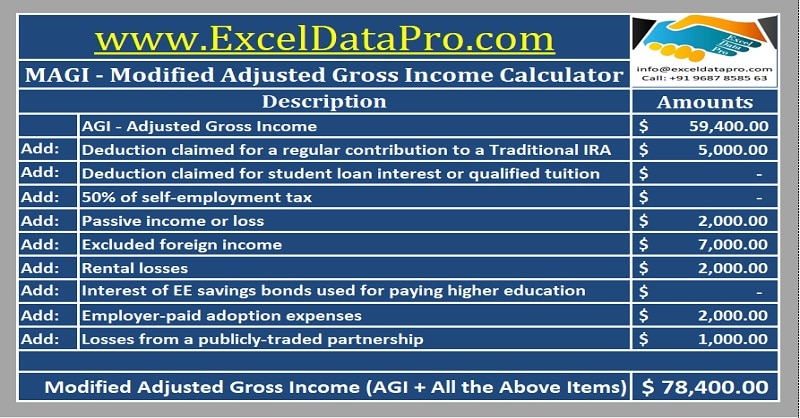

Mark Mark is a teacher who earned a salary of 45000 from the school district. On Form 1040 this means adding up line 1 through 7a. The modified adjusted gross income MAGI is calculated by taking the adjusted gross income and adding back certain allowable deductions.

This includes wages or salary from a job bank account interest stock dividends and rental property income. Adjusted gross income AGI is the number you get after you subtract your adjustments to income from your gross income. Many states also base their state income taxes on your federal AGI.

If you want to calculate your adjusted gross income then these handy tips may be useful. Bob and Sallys AGI equals 90000 90000 10000. Your AGI is the total amount of income you make in a year minus certain expenses that you are allowed to deduct.

Assume Bob and Sally are married and file a joint income tax return. Adjusted gross income or AGI is a persons total gross income minus specific deductions or payments made throughout the year. For the tax year 2020 check the line 8b on form 1040-SR.

Adjusted gross income the estate or trust must determine the amount of adjusted gross income. Bob and Sally each earned 90000 per year and their investments returned 10000 in dividends. In 202021 James has adjusted income of 250000 and threshold income of 210000.

For example you must calculate your MAGI if you want to deduct some of your student loan interest. First it includes all your income sources such as. To begin your adjusted gross income calculation youll need to gather all of your income statements.

How to calculate AGI The first step to calculating your AGI is to figure out your gross incomeyour total income for the tax year. There are two steps to finding your AGI. Gross income includes your wages dividends capital gains business income retirement distributions as well as other income.

This includes your W-2 for your wages and salaries anything listing your self-employment income and any income you have reported on various 1099 forms. Modified Adjusted Gross Income MAGI Throughout your return youll notice that the IRS also uses modified adjusted gross income or MAGI. MAGI calculation example MAGI calculator helps you estimate your modified adjusted gross income to determine your eligibility for certain tax benefits and government-subsidized health programs and whether you can make tax-deductible contributions to an individual retirement account or contribute to a Roth IRA.

Therefore your AGI will always be less than or equal to your gross income. The IRS uses MAGI to determine if a taxpayer is eligible to make certain tax deductions tax credits or retirement plans. Your AGI levels can also reduce your personal deductions and exemptions.

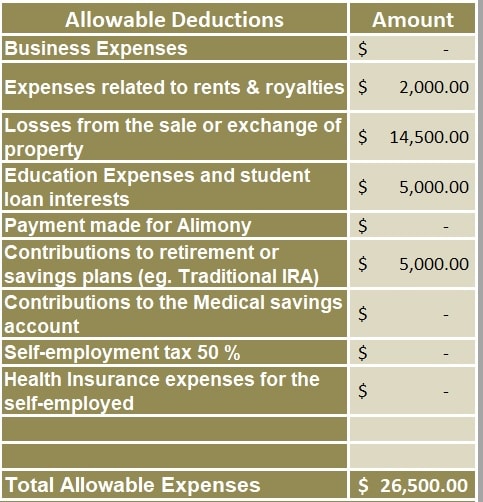

AGI is calculated by taking your gross income from the year and subtracting any deductions that you are eligible to claim. For example if an estate or trust has miscellaneous itemized deductions not exempted by 67e these deductions are deductible only to the extent they exceed 2 of the estate or trusts. Sally is able to claim a total of 4000 of income adjustments.

Thats why its so important.

How To Find Your Modified Adjusted Gross Income Novel Investor

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Gross Income Formula Calculator Examples With Excel Template

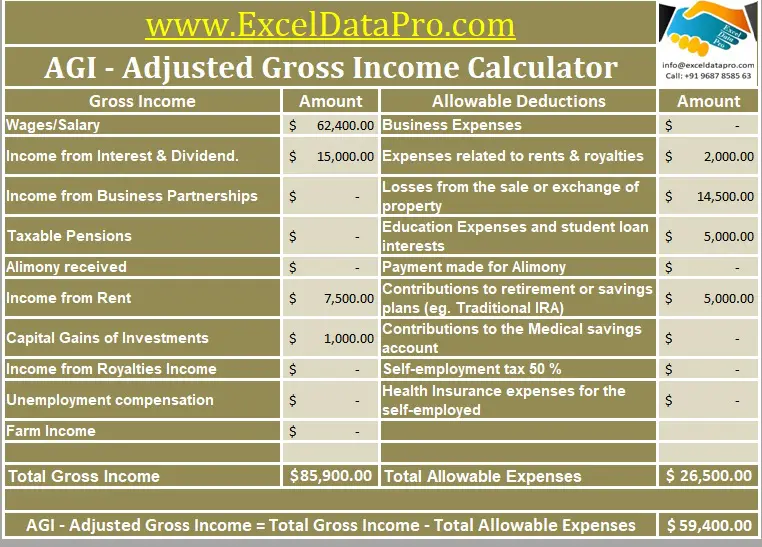

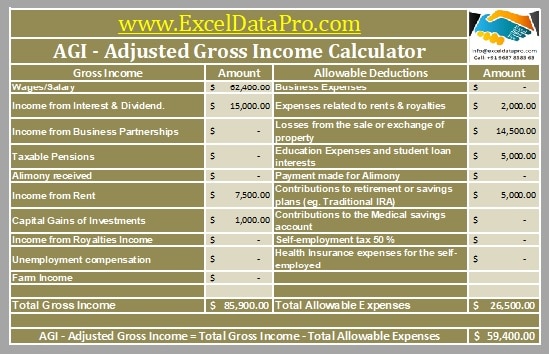

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

What Is Adjusted Gross Income Agi Gusto

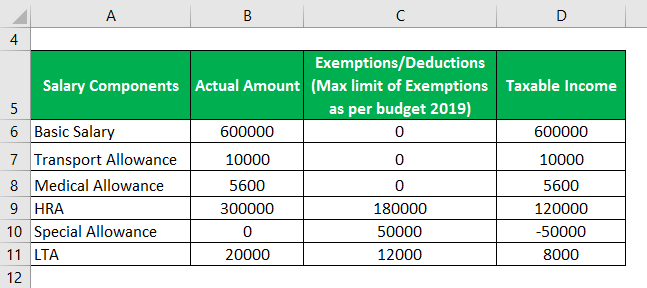

Taxable Income Formula Calculator Examples With Excel Template

Standard Deduction Tax Exemption And Deduction Taxact Blog

Calculate Adjusted Gross Income Agi Using W2 Tax Return Excel124

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Adjusted Gross Income Agi Gusto

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)

Net Income Vs Adjusted Gross Income Agi What S The Difference

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

What Should My Adjusted Gross Income Be

Adjusted Gross Income What Is Adjusted Gross Income Agi

Taxable Income Formula Calculator Examples With Excel Template

Agi Calculator Adjusted Gross Income Calculator

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Post a Comment for "Adjusted Gross Income Calculation Example"