Gross Income Calculator Canada

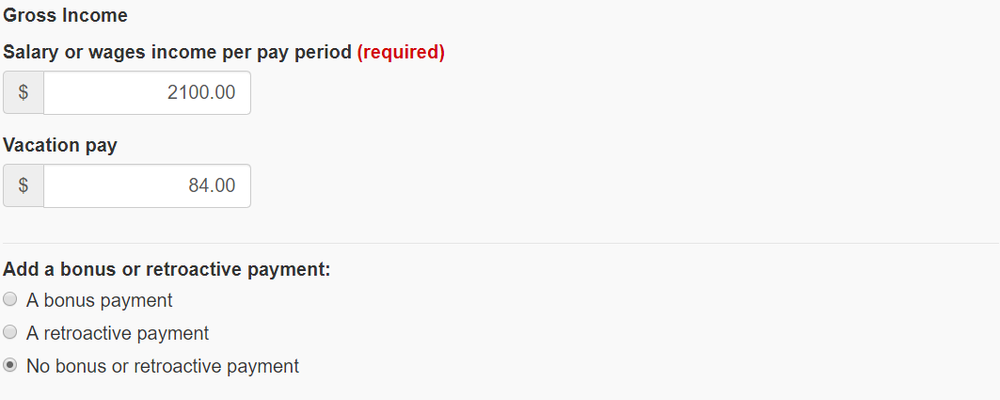

ADP Canada Canadian Payroll Calculator. You can use our Monthly Gross Income calculator to determine your gross income based on how frequently you are paid and the amount of income you make per pay period.

How To Calculate Net Income 12 Steps With Pictures Wikihow

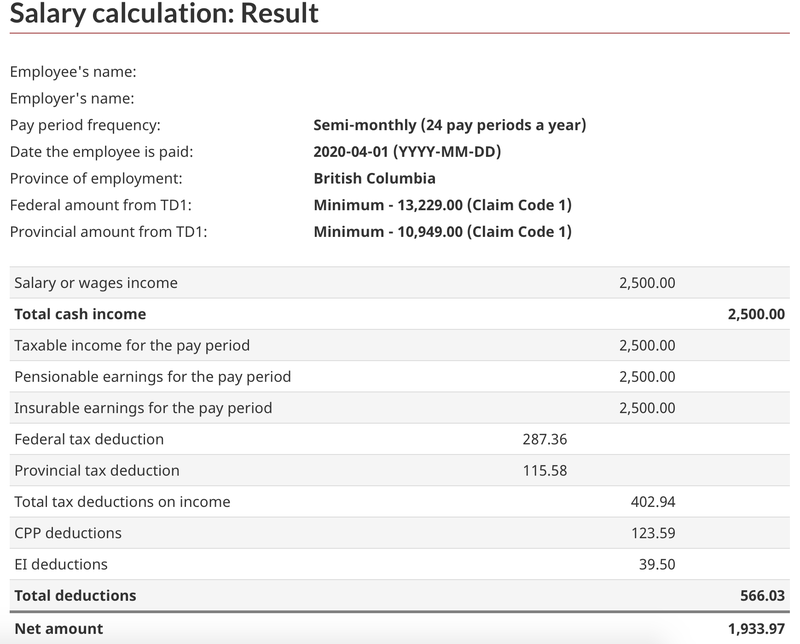

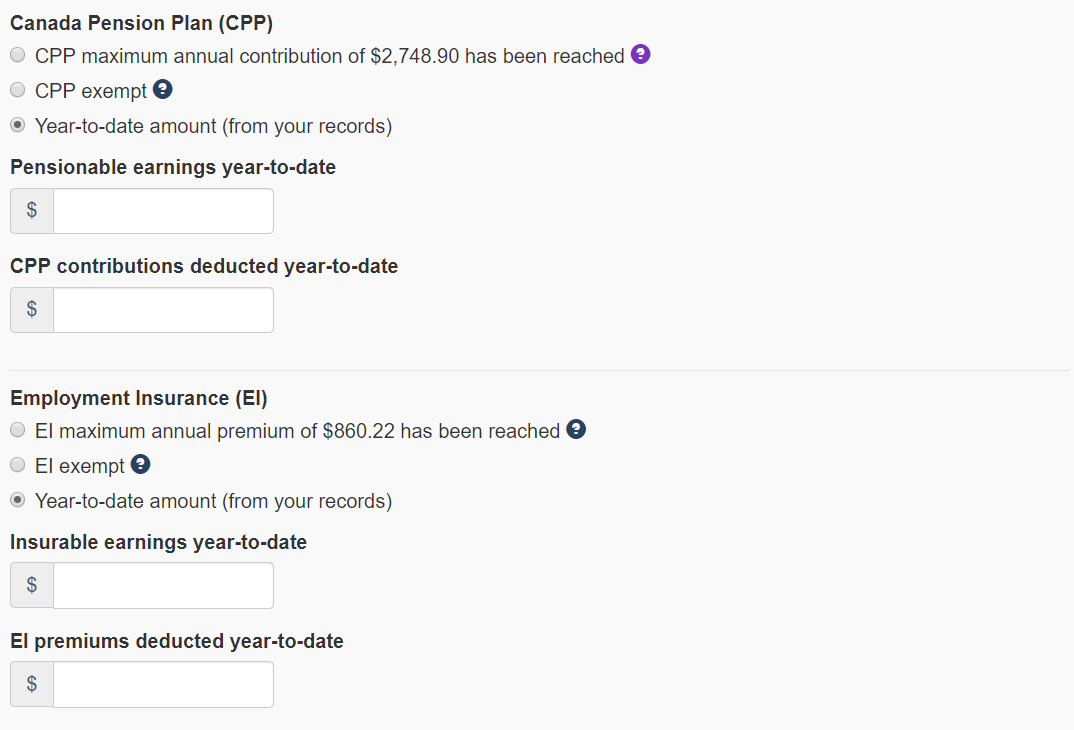

The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount.

Gross income calculator canada. The Ontario Income Tax Salary Calculator is updated 202122 tax year. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Fill in the boxes below that apply to you to convert your actual pay or your payrate.

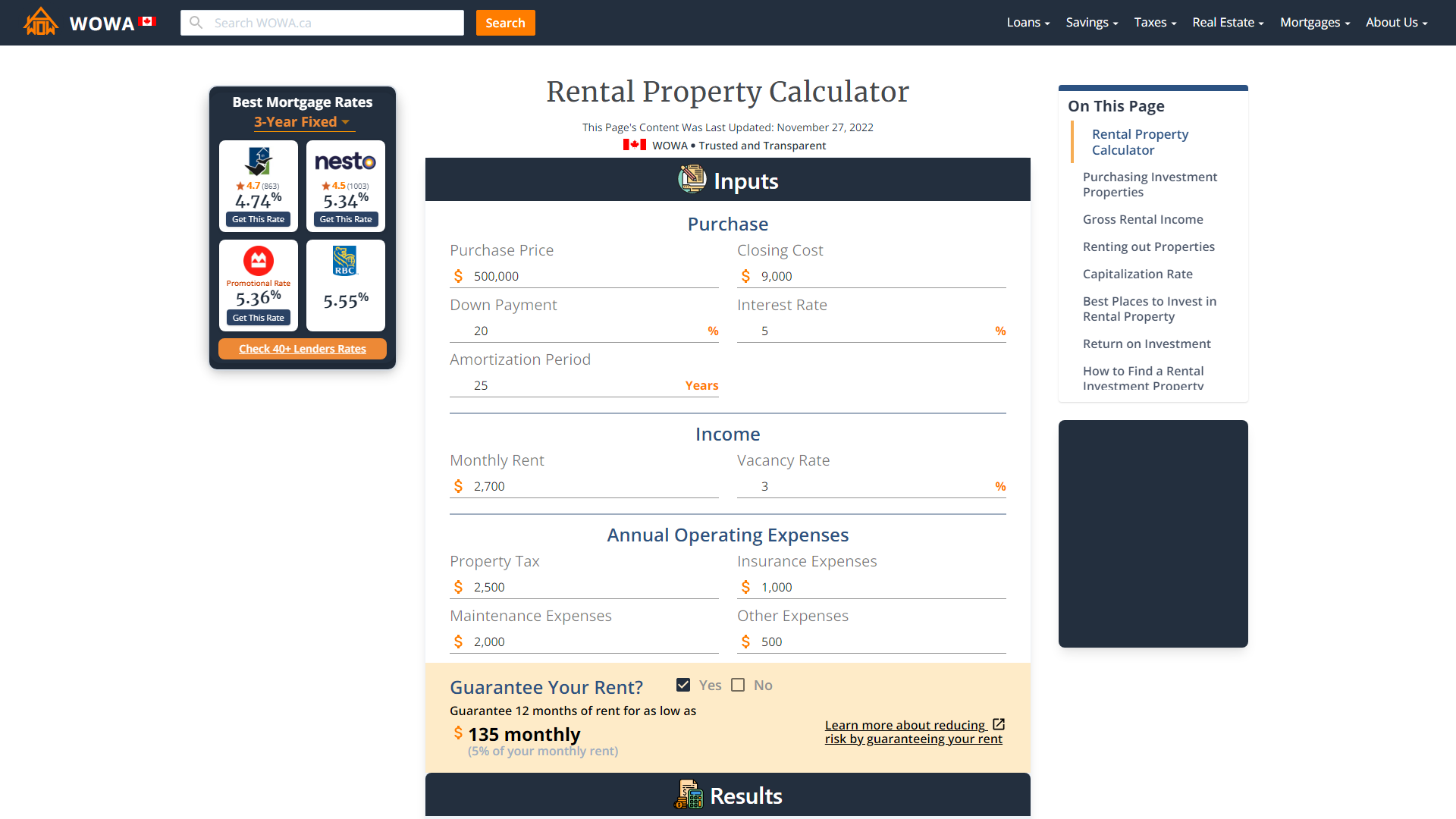

To start complete the easy-to-follow form below. Gross Salary Calculator Need to start with an employees net after-tax pay and work your way back to gross pay. Middle-class income in Canada has a salary range of 36598 to 73115 According to this Nanos Research study most Canadians had widely varying views on what is considered middle-class for example 22 of Canadians believed that 150000 in yearly income was required to make it into middle-class whereas 18 believed 100000 was sufficient and 12 believed 50000.

One of a suite of free online calculators provided by the team at iCalculator. After-tax income is your total income net of federal tax provincial tax and payroll tax. If You are looking to calculate your salary in a different province in Canada you can select an alternate province here.

Instead they are calculated using the amount of pensionable earnings minus a basic exemption amount that is based on the period of employment. What you will find on this page is a household income percentile calculator for Canada for 2021 along with 17 Canadian household income statistics. Calculations will not be as accurate for other types of income as different tax considerations apply.

Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. The payroll calculator from ADP is easy-to-use and FREE. This is the total amount of net income you make in a month.

Income from line 150 of your income tax return. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Use this simple powerful tool whether your staff is paid salary or hourly and for every province or territory in Canada.

This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of 2021. Rates are up to date as of June 22 2021. But do you know what is payroll and how is it calculated.

Gross pay is what you make before any deductions are made taxes etc. This calculator is for you. If you are paid hourly multiply your hourly.

How do you calculate your take-h. Select how often you are paid and input how much money you earn per pay period and the calculator shows you your monthly gross income. If you have a job you receive your salary through the monthly bi-weekly or weekly payroll.

The figures are imprecise and reflect the approximate salary range for tech professionals in. We use net after-tax instead of gross before tax because you make debt payments with money after taxes. Net salary calculator from annual gross income in Ontario 2021.

For Canada Pension Plan CPP purposes contributions are not calculated from the first dollar of pensionable earnings. 2020 2021 Canadian. Fill the weeks and hours sections as desired to get your personnal net income.

Table 1 - Guaranteed Income Supplement GIS amounts for an income range of 000 to 43199 GIS for single person who receives an Old Age Security pension Yearly Income excluding OAS Pension and GIS. Using the Debt to Income Ratio Calculator. It assumes all income is employment income ie.

This calculator estimates after tax income based on gross income and provincial residence applying common tax credits and deductions. A minimum base salary for Software Developers DevOps QA and other tech professionals in Canada starts at C 85000 per year. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of C 150000 without bonuses.

Enter your household income not individual income in Canadian dollars select your province and the household income percentile calculator will let you know where you stand in regards to percentile compared to other Canadian households. It is perfect for small business especially those new to doing payroll. The 2021 Tax Calculator includes Federal and Province tax calculations for all income expense and tax credit scenarios.

Updated for 2021 the Canada Tax Return Calculator is a complex yet simple way to estimate your salary and payroll. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. But 4 weeks multiplied by 12 months 48.

Canadian Payroll Calculator - the easiest way to calculate your payroll taxes and estimate your after-tax salary. Generally most people think of a month as having 4 weeks. As of 2019 the Canada Pension Plan is being enhanced over a 7 year phase-in.

See how we can help improve your knowledge of Math Physics Tax. These calculations are approximate and include the following non-refundable tax credits. Start by entering your monthly income.

There are 12 months and 52 weeks in a year.

Rental Property Calculator 2021 Wowa Ca

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Avanti Gross Salary Calculator

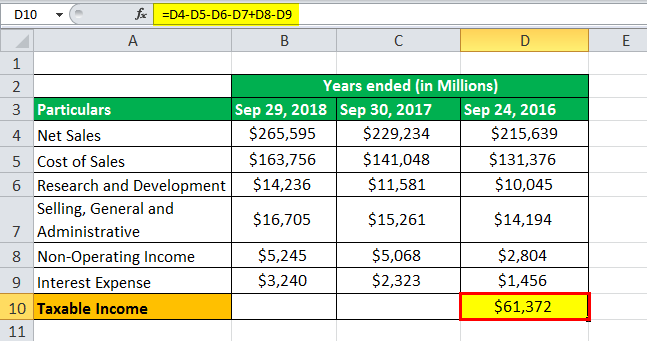

Taxable Income Formula Examples How To Calculate Taxable Income

What Is Gross Vs Net Income Definitions And How To Calculate Mbo Partners

Income Tax Calculator Calculatorscanada Ca

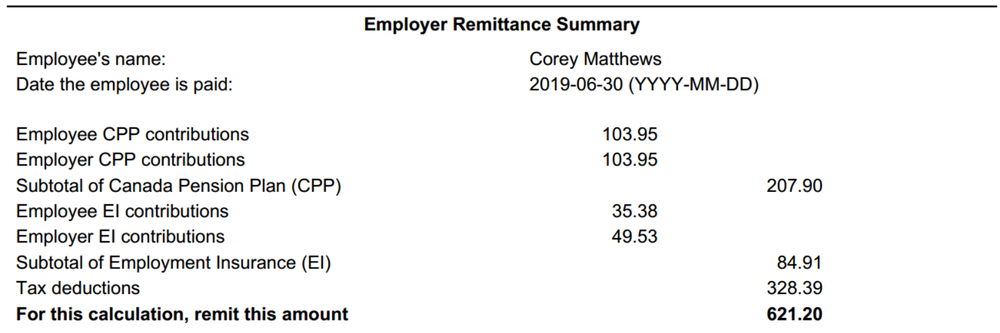

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Taxable Income Formula Examples How To Calculate Taxable Income

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Taxable Income Formula Examples How To Calculate Taxable Income

Mathematics For Work And Everyday Life

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Annual Income Learn How To Calculate Total Annual Income

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

How To Calculate Payroll Tax Deductions Monster Ca

Post a Comment for "Gross Income Calculator Canada"