Gross Income Calculator California

Spouse Income. The California Salary Calculator allows you to quickly calculate your salary after tax including California State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting California state tax tables.

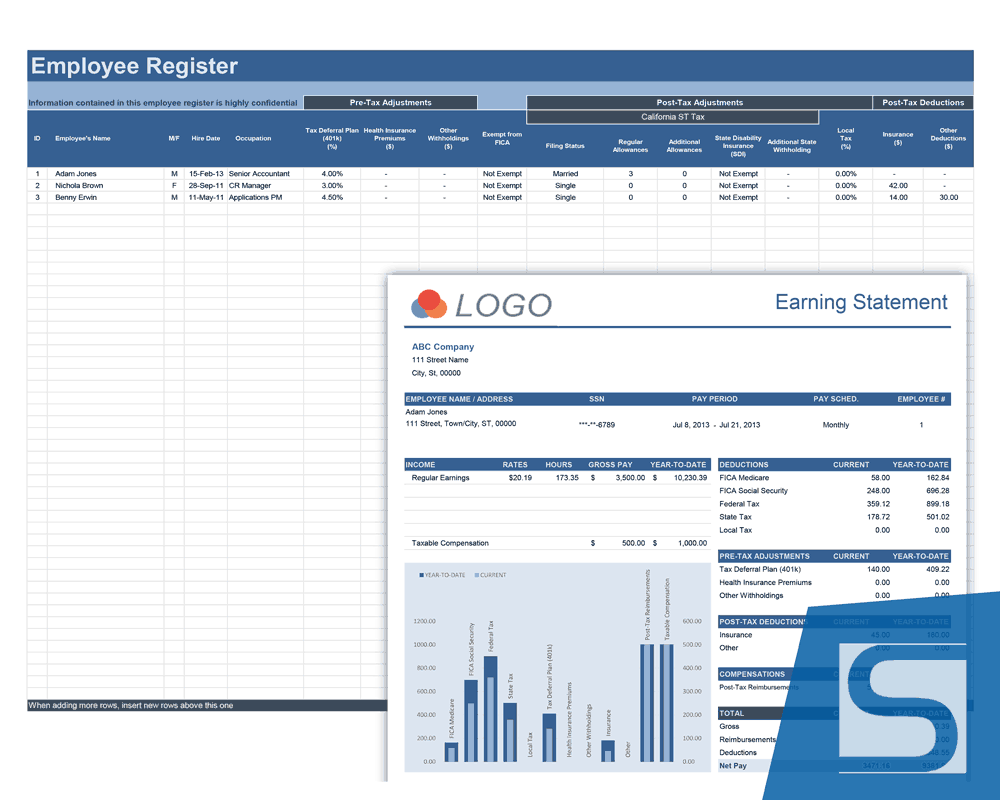

Payroll Calculator Free Employee Payroll Template For Excel

Payroll check calculator is updated for payroll year 2021 and new W4.

Gross income calculator california. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040. If your state does not have a special supplemental rate you will be forwarded to the aggregate. If this spouse has no income enter 0.

You can also choose comparison states and show the income. If you make 55000 a year living in the region of California USA you will be taxed 12070That means that your net pay will be 42930 per year or 3577 per month. Enter your info to see your take home pay.

If you earn 12000000 or earn close to it and live in California then this will give you a rough idea of how much you will be paying in taxes on an annual basis. CalFresh Income Limits for 2021. Cover and Preface DOC Chapter One - Overview DOC Chapter Two - General Requirements DOC Chapter Three - Calculating Annual Gross Income DOC Chapter Four - Recertification of Income Eligibility DOC Chapter Five - Calculating Adjusted Income DOC.

This calculator is for you. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. One of a suite of free online calculators provided by the team at iCalculator.

On this page is a 2020 income percentile by state calculator for the United States. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. In order to fully understand how child support is computed we have to first determine what is included in.

In all there are 10 official income tax brackets in California with rates ranging from as. Income Calculation and Determination Guide for Federal Programs First Edition July 2010. This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The CalFresh Income Limits for 2021 is based on your households total income and size. The net disposable income of the parent is computed by taking the gross income and then deducting the allowable deductions.

To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. If you dont know the exact amount enter an estimate. For the calculation we will be basing all of our steps on the idea that the individual filing their taxes has a salary of 12000000.

It determines the amount of gross wages before taxes and deductions. Gross Salary Calculator Need to start with an employees net after-tax pay and work your way back to gross pay. It works for either individual income or household income or alternatively only to compare salary wage income.

Annual Gross Income We need the income of both you and your spouse to calculate the support amount. In calculating child support the key financial factor is the net disposable income of the parent. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. SalaryWage and Tax Calculator - Estonia Latvia This website may use cookies or similar technologies to personalize ads interest-based advertising to provide social media features and to analyze our traffic. To find out if your income meets the eligibility requirements you must first calculate the gross monthly income for your household.

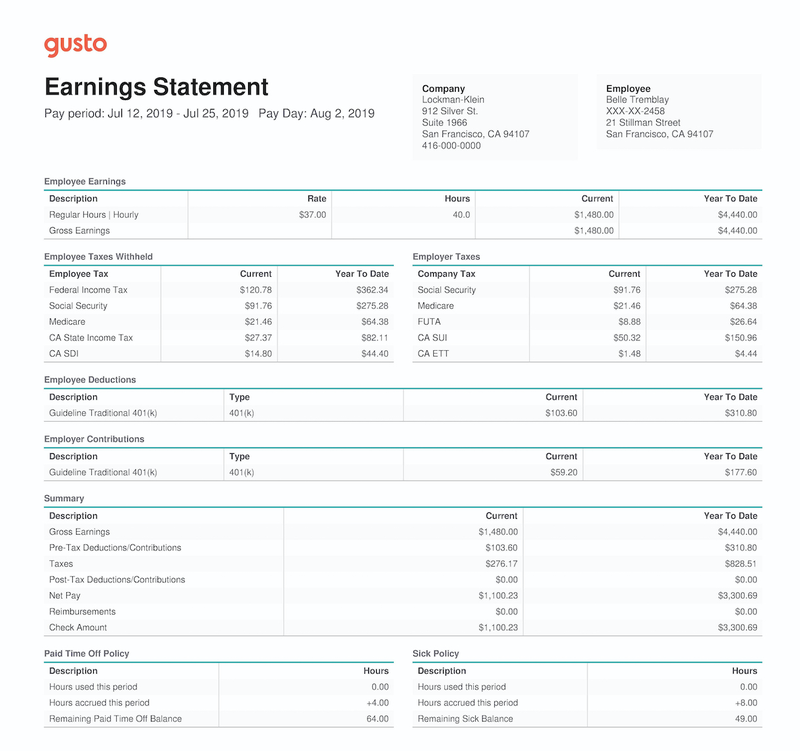

After a few seconds you will be provided with a full breakdown of the tax you are paying. Your average tax rate is 220 and your marginal tax rate is 397This marginal tax rate means that your immediate additional income will be taxed at this rate. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

Use this California gross pay calculator to gross up wages based on net pay. Enter pre-tax income earned between January and December 2019 and select a state and income type to compare an income percentile. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

California Salary Paycheck Calculator. Tax Filing Status. This is similar to the federal income tax system.

These calculators use supplemental tax rates to calculate withholdings on special wage payments such as bonuses. SalaryWage and taxes in Latvia. California Income Taxes.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. California has a progressive income tax which means rates are lower for lower earners and higher for higher earners.

What Is A Breakdown For Take Home Pay On A 120 000 Salary Living In San Francisco Quora

Understanding Your Pay Statement Office Of Human Resources

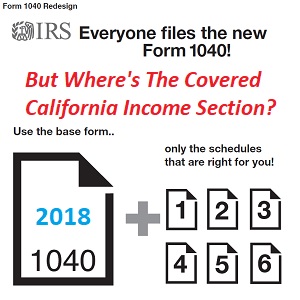

What Type Of Income Is Counted For Covered California Aca Plans

Gross Wages What Is It And How Do You Calculate It The Blueprint

New Adjusted Gross Income Federal Income Tax Line For Covered California Income Estimates

Payroll Calculator Free Employee Payroll Template For Excel

Calfresh Income Limits 2021 California Food Stamps Help

What Is A Breakdown For Take Home Pay On A 120 000 Salary Living In San Francisco Quora

Paycheck Taxes Federal State Local Withholding H R Block

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Calculating Paid Family Leave Benefit Payment Amounts

How To Calculate California Unemployment How Much Will You Get

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

All About The Covered California Income Limits Ehealth

Paycheck Calculator Take Home Pay Calculator

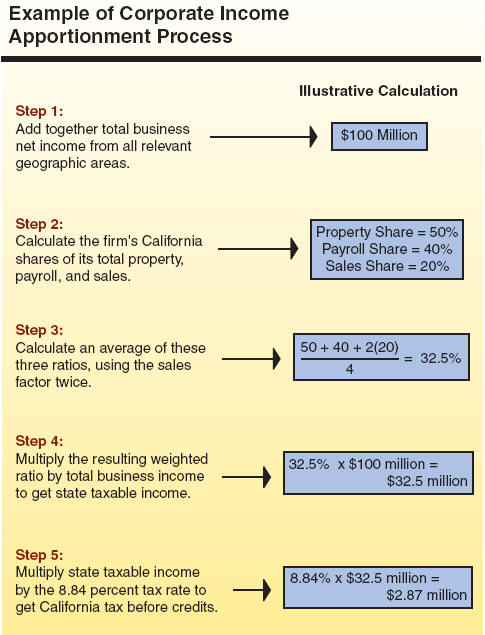

California S Tax System A Primer

Paycheck Calculator Take Home Pay Calculator

Arizona Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Post a Comment for "Gross Income Calculator California"