Take Home Salary Pro Rata

You can work out your take-home pay using our free prorated salary calculator which will also work out the Income Tax and National Insurance due. Use our Take Home salary calculator to work out what your salary should be after tax.

Pro Rata Definition Uses And Practical Example

Take-Home Hourly Pay Desired Salary Pro-Rata How They Work.

Take home salary pro rata. Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO. You can also enter a percentage of your full salary if. The basic calculation you can use to work out pro rata is as follows.

This scheme offers support to employers who bring their staff back to work gradually. The figures are based on the 201718 tax year which started on. PRSI is only applicable to salaries higher than 5000 EUR per year.

As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well. It includes things like pensions auto-enrolment student loans as well as the usual income tax and national insurance. So for the example above this would look as follows.

The meaning of pro rata or the definition of pro rata according to Cambridge Dictionary is essentially to be paid in proportion of a fixed rate for a larger amount. How to work out pro rata salary. Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in.

The government contribution is capped at 154175 per month. Visit revenueie for more details. 30000 annual salary 40 full time hours 750 750 x 25 pro rata hours 18750.

The simplest way to work out how much youd be paid on a pro rata basis is dividing the annual salary by the number of full time hours and then times this number by the pro rata hours. The better way to calculate pro rata pay entitlement is to work it out by hours rather than days. Pro-Rata Furlough Tax Calculator.

How to use the Pro-Rata Salary Calculator To use the pro-rata salary calculator enter the full-time annual salary in the Full-time Salary box. 20000 x 18 375 9600. 37 hours per week term time only.

For example if your annual salary pro rata is 30000 in a 40-hour week but you actually only worked 25 hours a week your part time salary would be 18750. Includes Tax on Government Bonus. Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000.

705 x 37 hours per week 26085 x 39 weeks 1017315 per year. The information presented here is based on the fiscal regulations in Ireland in 2021. For example you may be paid an annual salary of 25000 pro rata - but you only actually work for part time in which case youll be paid a proportion of the 25000 based on how much of the expected time youre actually working.

To help illustrate this and figure out exactly how much you get to take home from your pro-rata salary we have produced this simple pro-rata tax calculator to do all the annoying number crunching for you. Pay Related Social Insurance PRSI is a tax payable on the gross income after deducting pension contributions. The latest tax information from January 2021 has been applied.

Enter the number of weekly hours that are considered full-time into the Full-time weekly hours box and the new pro-rata number of weekly hours into the Pro-rata weekly hours box. Use our pro-rata salary calculator to work out what your actual pay will be if you do a part-time job. Just type your salary in the Annual Gross.

The council site states teacher working days would be 195 day per year which works out at 39 weeks guess it is same for support staff. In addition to income tax there are additional levies such as Medicare. 1 The Statutory Bonus of 13510 is paid every six months and equates to 074 per calendar day including Saturdays and Sundays on a pro-rata basis.

Payments are made at the end of June and December and will be included in your payslips. This isnt always 100 accurate. R 428307 as per PAYE tables provided by SARS Take home pay Gross salary - PAYE - UIF UIF Unemployment Insurance Fund is levied at 1 of your taxable income at most R14872month Take home pay R 18000 - R 428307 - R 6864.

For reduced hours most employers will multiply the full-time salary by the reduced number of hours divided by the full-time hours. If you need an Income Tax Calculator youve come to the right place. Part-time jobs are often advertised with full-time salaries.

Simply change the. For example if the full-time salary is 20000 per year for 375 hours work per week the pro-rata salary based on a 18-hour working week would be. You can also see the impact of your pension contributions.

Recently Ive had a couple of requests from users of the site to have a pro-rata calculator on the site so you can work out what your new pay would be if you go down to reduced hours or enter a job share of some sort. The Salary Calculator helps you to see what your take-home pay will be once you have paid income tax Universal Social Charge USC and Pay-Related Social Insurance PRSI. Annual salary full-time hours x actual work hours.

The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how your take-home pay will be affected. Tax you will pay PAYE Pay As You Earn for your age group and income bracket.

So I take it I would start on the low rate. Field then press enter.

Https Www Solihullcommunityhousing Org Uk Images Stories Fleximedia Askmat Calculating A Prorata Offer Pdf

Pro Rata Commercial Real Estate Terms Explained Gmaven Dictionary

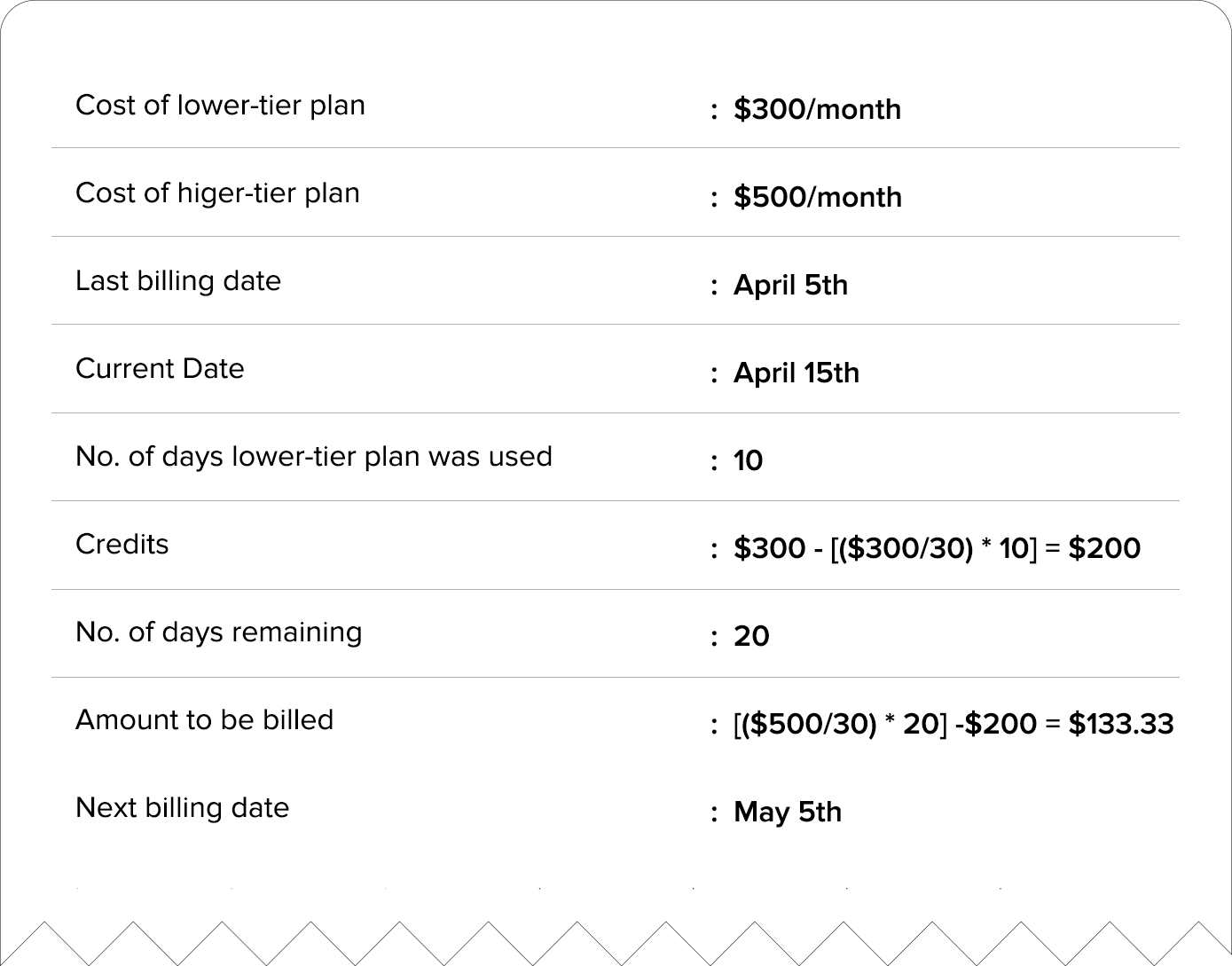

Calculate Pro Rata Everything You Need To Know Tide Business

Calculate Pro Rata Everything You Need To Know Tide Business

Web 3 0 Natural Language Processing Flexible Working Salary Calculator

How Do You Calculate Pro Rata Holiday Entitlement Citrushr

How Prorated Billing Works In Saas Businesses Zoho Subscriptions

Calculate Pro Rata Everything You Need To Know Tide Business

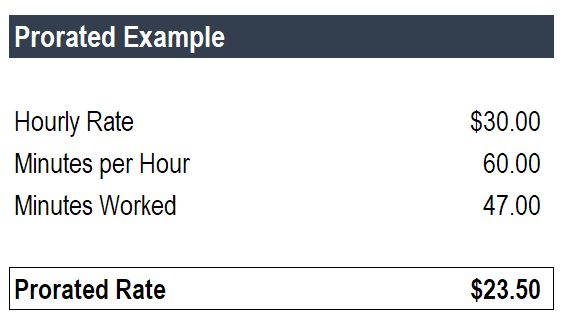

Prorated Learn When To Use And How To Prorate A Number

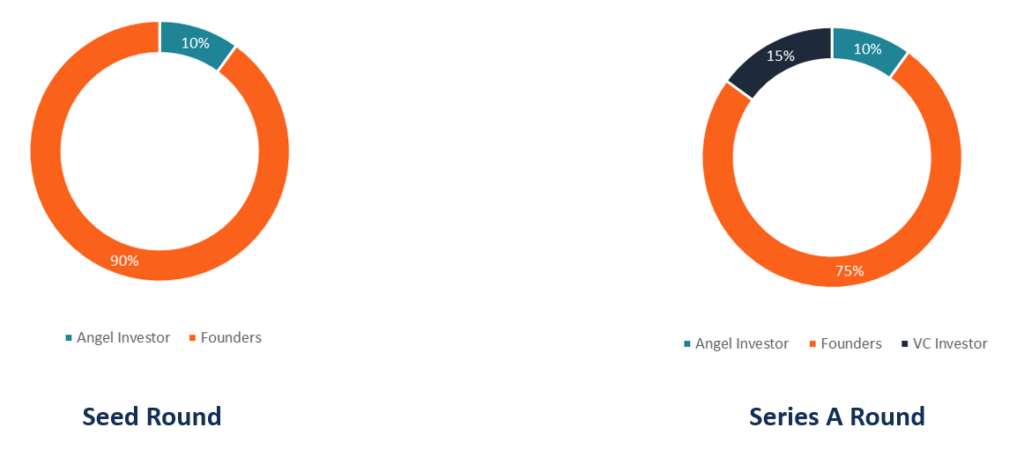

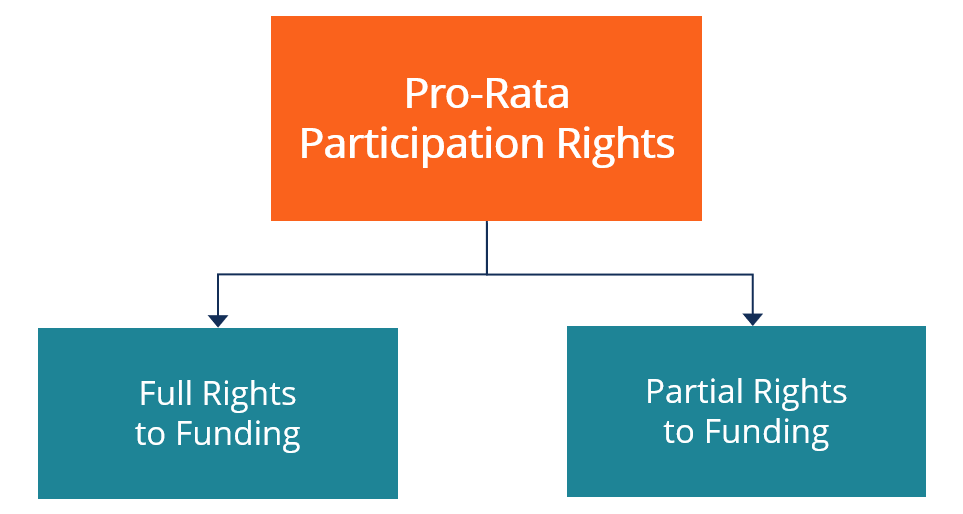

Pro Rata Right Definition How Do Pro Rata Rights Work

Pro Rata Over Subscription And Calls In Arrears

Pro Rata Participation Rights Overview How They Work Example

Pro Rata Salary Calculator Uk Tax Calculators

Calculate Pro Rata Everything You Need To Know Tide Business

Confused About Pro Rata Charges Here S Everything You Need To Know Arrow Voice Data

The Salary Calculator Hourly Wage Tax Calculator Salary Calculator Weekly Pay Loans For Poor Credit

Post a Comment for "Take Home Salary Pro Rata"